Our Products

Scandium

Scandium is an element that has many powerful uses in both civilian and defense technologies. The US government has designated scandium as “critical” to the US because of the many applications that require scandium and also because the US is 100% dependent upon foreign imports of scandium. NioCorp plans to address that dependency with the scandium we intend to produce in southeast Nebraska.

Scandium is an element that has many powerful uses in both civilian and defense technologies. The US government has designated scandium as “critical” to the US because of the many applications that require scandium and also because the US is 100% dependent upon foreign imports of scandium. NioCorp plans to address that dependency with the scandium we intend to produce in southeast Nebraska.

One of scandium’s most important uses is as an additive to aluminum. When combined with aluminum in very small quantities — typically less than one percent by weight — scandium produces an alloy with significantly more strength and corrosion resistance. Because of its increased strength, this allows for more efficient use of the alloy in applications such as electric vehicles and commercial aviation. That can significantly reduce weight, which increases range, fuel economy, and payload (especially in defense aviation).

For example, between $1.0-$1.5 million of scandium oxide in a single airliner offers $10-15 million in net present value fuel savings.

Aluminum-scandium alloy delivers another important benefit: the alloy can be reliably welded, which can virtually revolutionize manfacturing operations in both surface and air transportation.

Scandium is also used in environmentally preferred Solid Oxide Fuel Cells, an electricity production technology with high reliability and relatively low air emissions.

Only about 25 tonnes of scandium is produced globally at present, which severely restricts scandium’s use. As more supply is brought online — including in Nebraska — more of scandium’s latent demand can be filled.

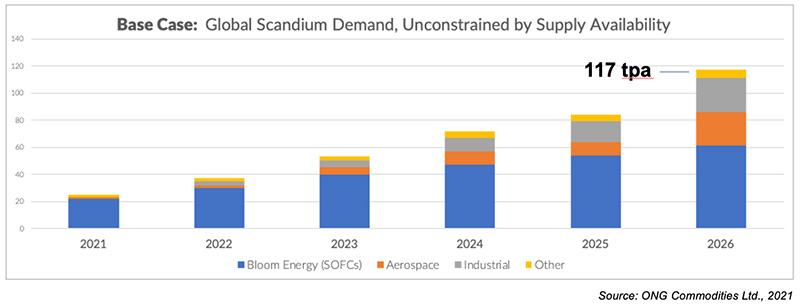

Below is an independent estimate of global scandium demand, assuming that sufficient scandium supply is available to meet demand.

Scandium and its Prospective Markets

- Forecast demand for scandium (117 tpy by 2026) greatly exceeds current supply (25 tonnes/year) and exceeds NioCorp’s potential annual scandium production.

- Solid oxide fuel cell use of Scandium (⋍22 tpy) is forecast to grow at 23% CAGR

- Aerospace + industrial use in 2022 (⋍5 tpy) is forecast to reach 50tpy over next 5 years

- Momentum is building in the market, with new pilot production from Rio Tinto and planned production from others.

- Potential in EV/Automotive: Net pounds of aluminum per light duty vehicle is forecast to increase from 459 lbs. in 2020 to 570 lbs. in 2030,3 representing a large potential for scandium use in aluminum-scandium alloys, even at low overall penetration; just 10% of this volume using 0.1% scandium would mean 700 tons/year scandium demand.

Demand Drivers for Scandium

Increasing Focus on Light Weighting

With the world’s Increasing focus on lighter-weight and more fuel efficient surface and air transportation systems, demand for scandium is expected to rise as scandium production increases.

How effective is scandium at reducing weight and delivering savings?Approximately $2M of scandium in a single airliner offers an estimated $27M million of net present value in fuel savings.

Consumption Constrained by Supply

With the need for lighter-weight and more fuel efficient railway cars and large transport, the potential for increased scandium demand is high.

One of the world’s largest aluminum companies has already produced aluminum-scandium rail hopper cars.

Strong Demand Growth Forecast

Automakers are working hard to find ways to reduce the mass of their vehicles, particularly electric vehicles. Aluminum-scandium alloy can deliver this benefit, in addition to being reliably weldable.

The International Energy Agency forecasts 25% CAGR growth in demand for EVs to 2030.

About Scandium

| Name | Scandium |

| Atomic Number | 21 |

| Element Classification | Metal |

| Phase at Room Temp. | Solid |

| Melting Point | 1814 K (1541°C or 2806°F) |

| Boiling Point | 3109 K (2836°C or 5137°F) |

| Density | 2.99 grams per cubic centimeter |

To learn more about the element Scandium, please see the Royal Society of Chemistry’s Scandium page here.

Connect with us socially!