New Plan to Treat Water Onsite Instead of Discharging to the Missouri River Provides a Major Advance in Environmental Performance and Eliminates the Need for Any Further NEPA-Level Permits

Mining Plan Utilizes “Artificial Ground Freezing” Technology and Targets Higher-Grade Ore for Initial Mining, Which Helps to Increase Expected Operating Cash Flow by 23.6% in the First Five Years of Operation

NioCorp to Host Conference Call / Webcast on Monday, April 22, 2019 to Discuss Results

CENTENNIAL, Colo., April 16, 2019 — NioCorp Developments Ltd. (“NioCorp” or the “Company“) (TSX: NB; OTCQX: NIOBF) today released the details of a new design for the underground mine at its Elk Creek Superalloy Materials Project (the “Project”) in southeast Nebraska, as well as the results of an updated NI-43-101 Feasibility Study (“2019 FS”). This work completes a critical milestone and further de-risks the Project for project financing.

The 2019 FS update is expected to deliver higher Net Present Value (“NPV”), stronger investment returns, accelerated cash flows, a longer mine life, higher production of all of NioCorp’s planned products in the first 10 years of operation, and a further reduction in execution risk and environmental impacts as compared to the previous project Feasibility Study, which was completed in 2017 (“2017 FS”). An update to the Project’s Mineral Resources and Mineral Reserve estimate1 also was completed, which results in the following: Probable Mineral Reserve tonnage is expanded by 14.7%; tonnage in the Indicated Mineral Resources category is higher by 101.5%; and contained Niobium, Scandium and Titanium in the Indicated Mineral Resources category are higher by 63.9%, 67,4%, and 67.6%, respectively,

NioCorp To Host Conference Call and Webcast on Monday April 22, 2019

NioCorp will host a conference call and live webcast on Monday, April 22, 2019, at 10 a.m. Mountain, featuring Mark A. Smith, NioCorp’s CEO and Executive Chairman, and Scott Honan, President of Elk Creek Resources Corp., to discuss the results of the new Elk Creek mine plan, revised 2019 Feasibility Study, and the Project’s updated Mineral Resource and Mineral Reserve. Details on the conference call and webcast are provided below and participants can register here: https://attendee.gotowebinar.com/register/6302297693868155395.

2019 Elk Creek FS Expected to Deliver Higher NPV, Stronger Returns, Accelerated Cash Flows, Longer Mine Life, Reduced Risk, and Fewer Environmental Impacts

(Comparisons below are to 2017 FS. All currency figures in US $ unless otherwise noted.)

— Pre-tax NPV (8% discount rate) increases by 12.0% to $2.57 billion, and after-tax Internal Rate of Return (“IRR”) improves to 25.8%, which is an 18.9% increase.

— Pre-tax NPV (8% discount rate) increases by 12.0% to $2.57 billion, and after-tax Internal Rate of Return (“IRR”) improves to 25.8%, which is an 18.9% increase.

— Gross revenue over Life of Mine (“LoM”) of $20.8 billion is 16.2% higher.

— Cumulative revenue of $2.9 billion over the first 5 years of operation is 17.0% higher, and cumulative 10-year revenue of $5.8 billion is 9.2% higher.

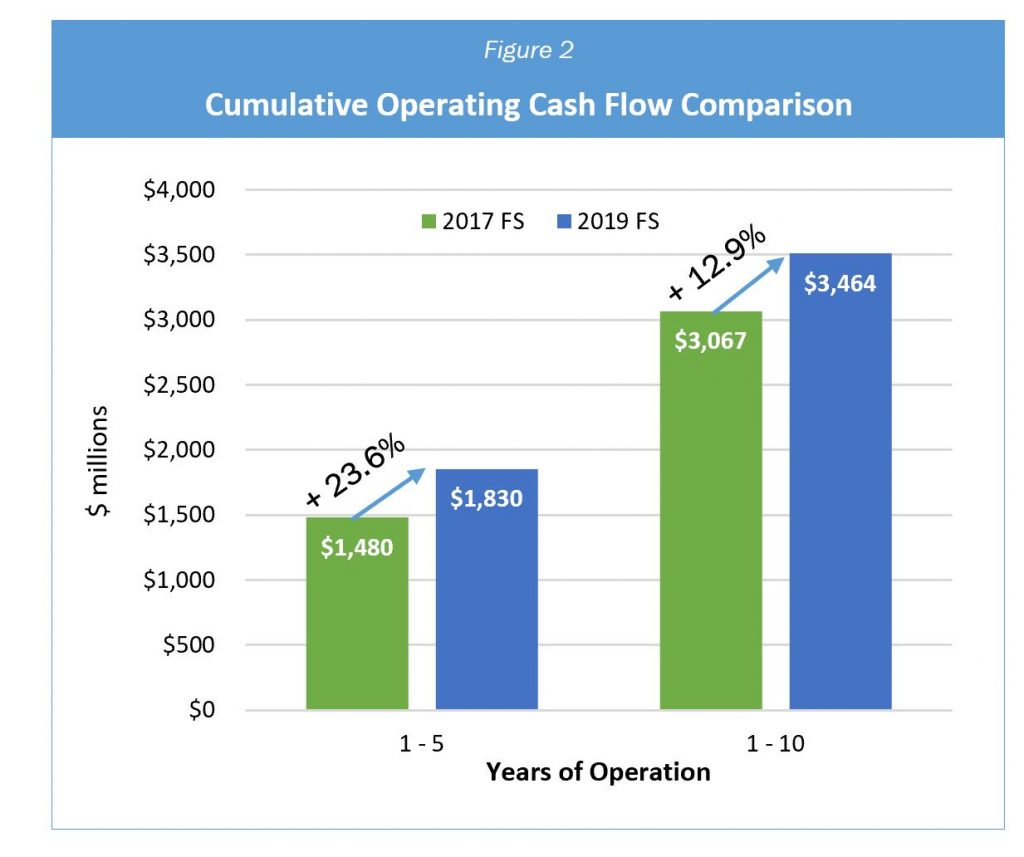

— Cumulative operating cash flow3 over the first 5 years of operation of $1.83 billion is higher by 23.6% and increases over the first 10 years of operation to $3.46 billion, a 12.9% increase.

— Cumulative EBITDA2 over the first 5 years of operation of $1.9 billion is 16.5% higher, and cumulative EBITDA over 10 years of $3.8 billion is 6.4% higher.

— Tonnage in the Project’s Probable Mineral Reserve has increased by 14.7%. Tonnage in Indicated Mineral Resources has increased by 101.5%.

— Contained Niobium, Scandium, and Titanium in the Project’s Indicated Mineral Resource have increased by 63.9%, 67.4%, and 67.6%, respectively.

— Mine life has increased from 32 years to 36 years, and the after-tax payback period from the onset of production has been reduced to 2.86 years.

— Environmental impacts and associated permitting risks are reduced further from the previous 2017 FS, including the utilization of artificial ground freezing technologies for mine shaft sinking, onsite water treatment that eliminates process water discharge, and the elimination of previous plans to discharge excess water into the Missouri River.

| Table 1 At A Glance: Improved Economics |

|||

| (US $millions) | 2017 FS | 2019 FS | Change |

| Pre-Tax NPV (8% discount rate) | $2,291 | $2,564 | 12.0% |

| After Tax IRR | 21.7% | 25.8% | 18.9% |

| Gross Revenue, LoM | $17,906 | $20,807 | 16.2% |

| Net Pre-production Capital Expenditures (“CAPEX”)2 | $1,008 | $879 | -12.9% |

| LoM OPEX (US$/mt) | $179.99 | $196.41 | 9.1% |

| After-Tax Payback Period (yrs.) | 3.68 | 2.86 | -22.4% |

| Mine Life (yrs.) | 32 | 36 | 12.5% |

The mine design, 2019 FS update, and an update to the Project’s Mineral Resource and Mineral Reserve were completed by the Nordmin Group of Companies (“Nordmin”), with technical inputs from other experts.

“This new design for the Elk Creek Project’s underground mine is expected to deliver a higher NPV, stronger investment returns, accelerated cash flows, a longer mine life, reduced permitting risk, and even greater improvements in overall environmental performance than the previous plan,” said Mark A. Smith, CEO and Executive Chairman of NioCorp. “This new mining plan and Feasibility Study update is a major step forward in the effort to advance the Elk Creek Project to financing, construction, and commercial operation.”

“This new design for the Elk Creek Project’s underground mine is expected to deliver a higher NPV, stronger investment returns, accelerated cash flows, a longer mine life, reduced permitting risk, and even greater improvements in overall environmental performance than the previous plan,” said Mark A. Smith, CEO and Executive Chairman of NioCorp. “This new mining plan and Feasibility Study update is a major step forward in the effort to advance the Elk Creek Project to financing, construction, and commercial operation.”

“Pre-tax NPV of $2.57 billion is 12% higher than in the previous Feasibility Study. After-tax IRR goes from 21.7% to 25.8%, an increase of 18.9%, so investment return is significantly improved. Life-of-mine revenue of $20.8 billion is higher by 16.2%. Of particular note is the fact this mining plan contributes to boosting our expected operating cash flows in the first five years of operations by 23.6% and helps to increase them by 12.9% over the first 10 years. Generating more cash on an accelerated basis should increase the Project’s economics.”

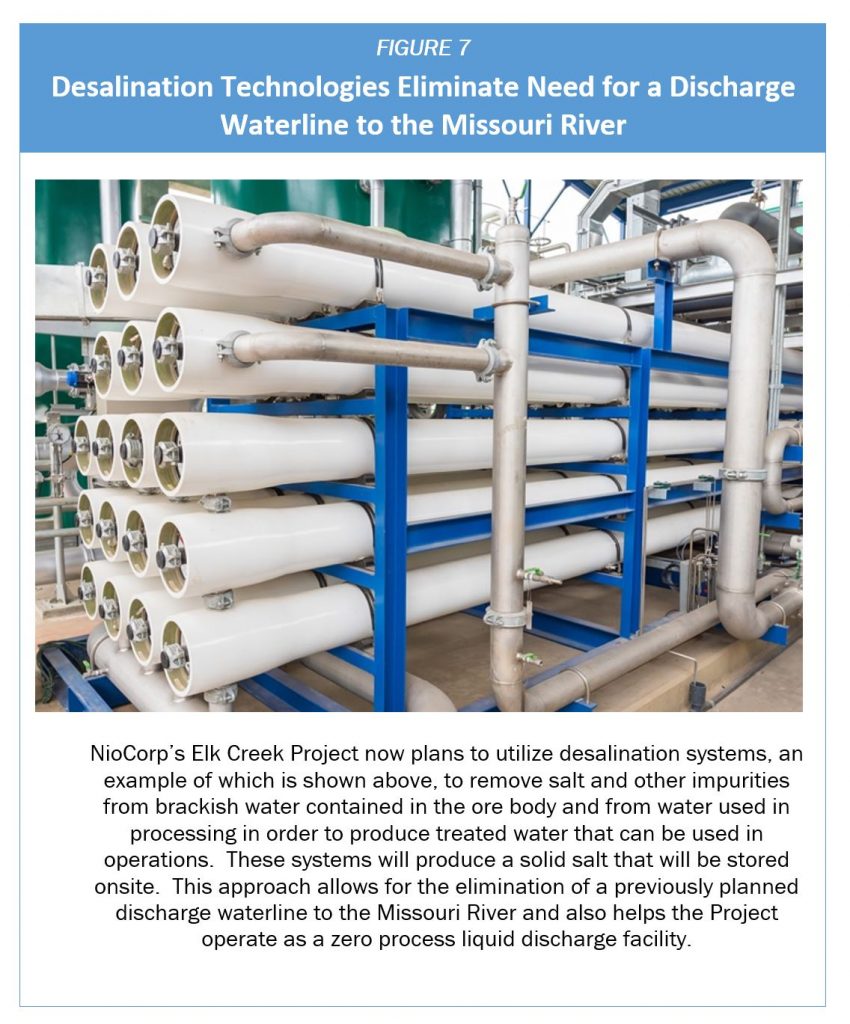

“I’m also pleased to see the stronger environmental performance this mining plan delivers to the Project,” Mr. Smith said. ”By deploying well-established technologies such as artificial ground freezing and desalination, we can now treat the slightly salty water that naturally exists deep underground in the ore body and remove the salt, allowing us to avoid having to discharge this bedrock water into the Missouri River. We also will be recycling virtually all of the water that we will be using in our processing. These are significant environmental advances of which our entire team is proud. Treating this water also eliminates the need to obtain any further NEPA-level environmental permits from the U.S. government. That further de-risks the Elk Creek Project in the eyes of long-term, strategic investors.”

“Net pre-production CAPEX has decreased by 12.9%, while total up-front CAPEX is up by 5.1%,” Mr. Smith said. “This increase is driven in part by the need for additional and larger water treatment equipment, by price inflation in construction materials and processing inputs over the last two years, and by the decision to target higher-grade ore at lower elevations in the mine earlier in the Project’s operational life. Targeting higher-grade ore helps to boost our expected operating cash flows over the first 10 years of operations. This trade-off should be attractive to strategic investors. In particular, strategic investors are likely to be clearly focused on the long-term financial returns of this critical minerals project as well as on the environmental benefits to society that our critical minerals promise to deliver. This mining plan and Feasibility Study update strengthen the value proposition of this investment even further.”

“Inflation in the construction materials sector, as measured by the Bureau of Labor Statistics’ Producer Price Index, has risen by 8.8%4 since our 2017 Feasibility Study was conducted,” Mr. Smith noted. “The fact that costs are rising for raw materials, processing inputs, machinery, and other components of our production facility is one reason why we are pushing hard to secure projecting financing and move to construction as rapidly as possible.”

Scott Honan, President of Elk Creek Resources Corp., the NioCorp subsidiary that will develop and operate the Project, said: “Completing the design engineering of a new underground mine is a large undertaking, and I am pleased with the success of this effort. This mine plan accelerates expected revenue generation in the first 10 years of operation while also delivering increased environmental performance. It paves the way for us to accelerate our ongoing work to complete detailed engineering of the surface processing facilities, where our goal is to find additional efficiencies and process improvements beyond those we have already incorporated into the Project. This mine plan advances us that much closer to a construction start, and our team is very excited to be able to build and operate this high-value critical minerals mine.”

Chris Dougherty, Chairman of the Nordmin Group of Companies, said: “Nordmin is pleased to bring added value to NioCorp’s Elk Creek Project. Through optimizing the mine plan, we have enhanced the Project’s economics while the use of ground freezing and other changes in underground development has further reduced the Project’s environmental impact. Our review indicates the potential of further enhancement of the Project value through expansion and definition of the deposit, beyond the increases that we identified in the report. The Elk Creek deposit is an exceptional deposit with a clear and well-defined plan that is backed by the work of many of the best engineering and geology minds in the business. We are very proud to be a part of this project and part of the NioCorp team.”

Chris Dougherty, Chairman of the Nordmin Group of Companies, said: “Nordmin is pleased to bring added value to NioCorp’s Elk Creek Project. Through optimizing the mine plan, we have enhanced the Project’s economics while the use of ground freezing and other changes in underground development has further reduced the Project’s environmental impact. Our review indicates the potential of further enhancement of the Project value through expansion and definition of the deposit, beyond the increases that we identified in the report. The Elk Creek deposit is an exceptional deposit with a clear and well-defined plan that is backed by the work of many of the best engineering and geology minds in the business. We are very proud to be a part of this project and part of the NioCorp team.”

2019 FS Summary Details

The 2019 FS financial model is based upon a mine life of 36 years with an annual steady state ore throughput rate of 1,009,000 metric tonnes (“mt”). At this rate, the Elk Creek Project is estimated to generate $20.8 billion in gross LoM revenue and $370 million in averaged annual EBITDA3 over its operating life. Below are some highlights of the 2019 FS findings.

|

Table 2 |

|||

| Description | 2017 FS | 2019 FS | Change |

| Pre-Tax NPV (8% discount) | $2,291 | $2,564 | 12.0% |

| Pre-Tax IRR | 24.3% | 27.3% | 12.4% |

| After-Tax NPV | $1,666 | $2,098 | 25.9% |

| After-Tax IRR | 21.7% | 25.8% | 18.9% |

| After-tax payback period from production onset (yrs.) | 3.68 | 2.86 | -22.3% |

| Net pre-production CAPEX2 | $1,008 | $879 | -12.8% |

| Mine Life (yrs.) | 32.0 | 36.0 | 12.5% |

| Life of Mine (“LoM”) Gross Revenue | $17,906 | $20,807 | 16.2% |

| Niobium | $5,695 | $7,860 | 38.0% |

| Scandium | $11,896 | $12,532 | 5.4% |

| Titanium | $316 | $414 | 31.3% |

| Averaged Annual EBITDA3 over LoM | $370 | $370 | — |

| Averaged EBITDA Margin3 (EBITDA as % of total revenue) |

69% | 67% | -3.4% |

| LoM OPEX (US$/mt) | $179.99 | $196.41 | 9.1% |

| Effective Tax Rate | 24.1% | 17.5% | -27.3% |

|

Table 3 |

|||

| Description | 2017 FS | 2019 FS | Change |

| Ore Mined (kt) | 31,661 | 36,313 | 14.7% |

| Mining Rate (mt/d) | 2,762 | 2,764 | 0.1% |

| Nb2O5 Grade | 0.79% | 0.81% | 2.3% |

| Scandium Grade (g/mt) | 71.58 | 65.71 | -8.2% |

| TiO2 Grade | 2.81% | 2.86% | 1.9% |

| Processing Rate (kt/y) | 1,009 | 1,009 | — |

| Average Recovery, Nb2O5 | 82.4% | 82.4% | — |

| Average Recovery Sc | 93.1% | 93.1% | — |

| Average Recovery TiO2 | 40.3% | 40.3% | — |

| Realized Product Prices | |||

| Nb ($/kg Nb as Ferroniobium) | $39.60 | $46.55 | 17.5% |

| Sc2O3 ($/kg as Sc2O3) | $3,675 | $3,676 | 0.0% |

| TiO2 ($/kg as TiO2) | $0.88 | $0.99 | 12.4% |

| Payable Metal | |||

| Nb (mt) | 143,824 | 168,861 | 17.4% |

| Sc2O3 (mt) | 3,237 | 3,410 | 5.3% |

| TiO2 (mt) | 359,128 | 418,841 | 16.6% |

| Table 4 Life of Mine Operations and Financial Profile |

|||||||||||||

| Operating Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 20 | 30 | |

| Production | |||||||||||||

| Niobium (mt-Nb) | 4,974 | 5,095 | 4,901 | 4,659 | 4,656 | 4,651 | 4,483 | 4,701 | 4,682 | 4,662 | 4,686 | 4,677 | |

| Scandium (mt-Sc2O3) | 112 | 109 | 103 | 95 | 96 | 91 | 97 | 100 | 104 | 100 | 100 | 88 | |

| Titanium (mt-TiO2) | 12,629 | 12,554 | 12,117 | 11,782 | 11,603 | 12,116 | 11,753 | 11,568 | 12,259 | 12,009 | 11,920 | 12,041 | |

| Realized Pricing | |||||||||||||

| Niobium ($/kg) | $45.46 | $45.46 | $45.46 | $45.46 | $45.46 | $45.46 | $45.46 | $45.46 | $45.46 | $46.06 | $47.00 | $47.00 | |

| Scandium ($/kg) | $3,985 | $3,486 | $2,988 | $3,086 | $3,186 | $3,384 | $3,584 | $3,734 | $3,735 | $3,750 | $3,750 | $3,750 | |

| Titanium ($/kg) | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | $0.99 | |

| Gross Revenues ($M) | $685 | $622 | $544 | $518 | $529 | $533 | $562 | $598 | $614 | $601 | $608 | $562 | |

| Total OPEX ($M) | ($201) | ($196) | ($197) | ($198) | ($199) | ($191) | ($199) | ($196) | ($207) | ($206) | ($204) | ($193) | |

| EBITDA ($M) | $484 | $427 | $347 | $320 | $330 | $342 | $363 | $402 | $406 | $395 | $404 | $368 | |

| EBITDA Margin | 71% | 69% | 64% | 62% | 62% | 64% | 65% | 67% | 66% | 66% | 66% | 66% | |

| Operating Cash Flow ($M) | $484 | $427 | $335 | $289 | $294 | $299 | $310 | $341 | $346 | $338 | $322 | $291 | |

| EBT ($M) | $224 | $207 | $161 | $151 | $179 | $216 | $255 | $292 | $293 | $281 | $290 | $268 | |

| Net Income ($M) | $224 | $207 | $149 | $120 | $142 | $173 | $202 | $232 | $233 | $223 | $207 | $191 | |

| Net Income Margin | 33% | 33% | 27% | 23% | 27% | 32% | 36% | 39% | 38% | 37% | 34% | 34% | |

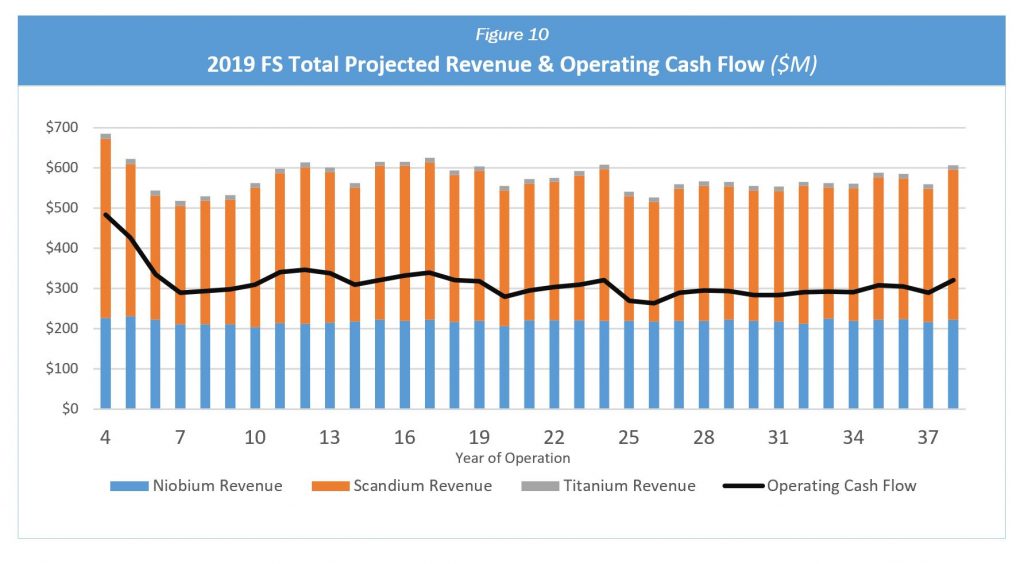

Production Profile and Gross Revenue

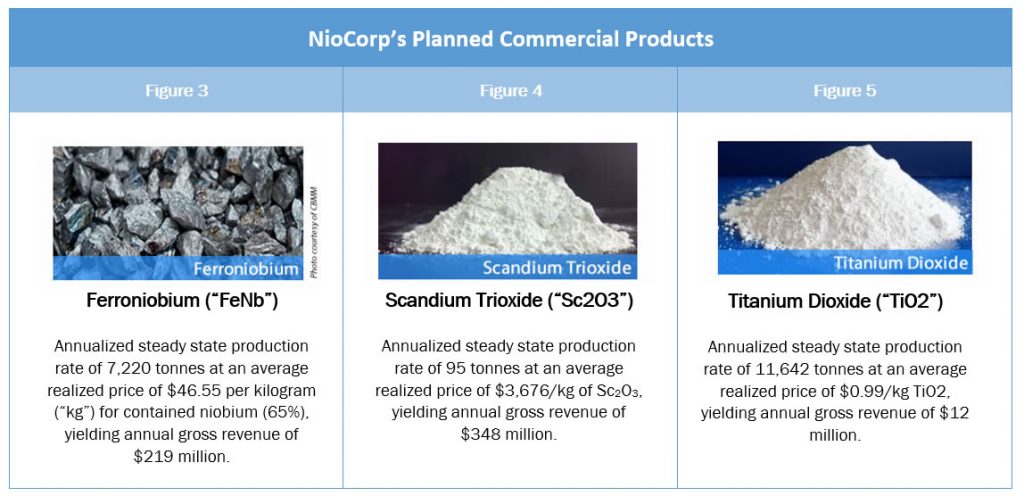

When in operation, the Project is expected to be the sole producer of Scandium oxide and a commercial version of Niobium, known as Ferroniobium, in the U.S., and one of only a handful of producers in the world of these critical and strategic materials. The 2019 FS assumes a 10-month commissioning and ramp up period to the facility’s nameplate production capacity from first ore, while the 2017 FS assumed a nine-month period for the same activity. Estimated production and revenues in the 2019 FS are as follows:

|

Table 5 |

||

| Average Annual Production Over Run of Mine5 | ||

| Description | Tonnes/Year | Revenue/Year ($ millions) |

| Ferroniobium | 7,220 | $219 |

| Scandium Trioxide | 95 | $348 |

| Titanium Dioxide | 11,642 | $12 |

| Life of Mine Revenue Breakdown6 | ||

| Description | Revenue ($millions) |

Proportion of Revenue |

| Ferroniobium | $7,860 | 37.8% |

| Scandium Trioxide | $12,532 | 60.2% |

| Titanium Dioxide | $414 | 2.0% |

| TOTAL | $20,807 | 100% |

Note: Totals may not sum due to rounding.

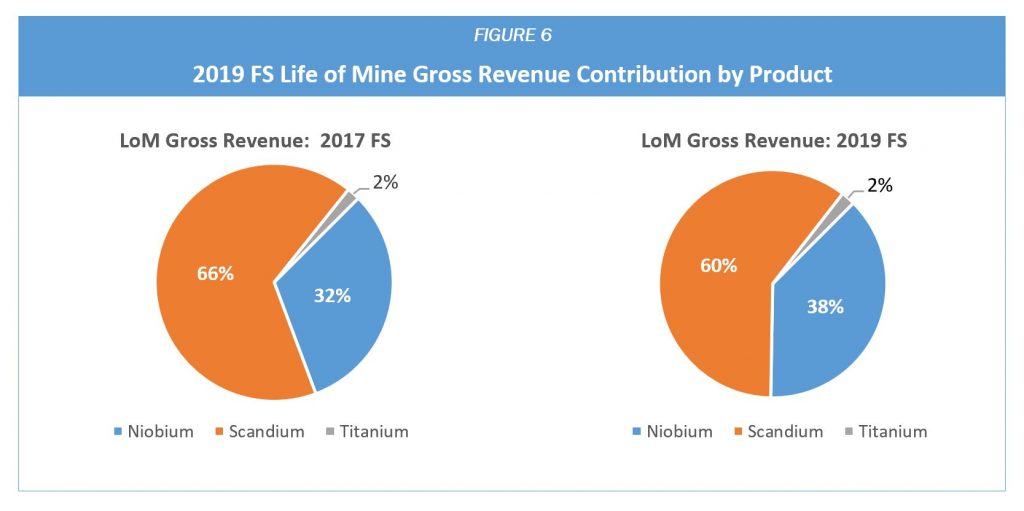

Increased Revenue From Niobium

In the 2019 FS mine plan, Niobium production generates more revenue as a percentage of total revenue than in the 2017 FS, as shown in Figure 6 below. This result is driven by the updated mine plan’s targeting of higher niobium grades in the early years of mining operations and because commodity pricing for Niobium has increased since the issuance of the 2017 FS.

Improved Environmental Performance

The new mine plan further reinforces the environmental performance of the Elk Creek Project. Together with previously disclosed environmental and process innovations incorporated in the 2017 FS, the Project now incorporates these following strategies and technologies designed to minimize environmental impacts of operation:

— Zero Process Liquid Discharge: The Elk Creek facility will now operate as a Zero Process Liquid Discharge facility, with no releases of process liquids. Instead, both naturally occurring, brackish (slightly salty) water produced during mining operations, and water used in ore processing, will be treated onsite for use in operations. A solid salt will be produced from water treatment operations which will be stored onsite.

— No Wastewater Discharge to the Missouri River: By treating water onsite, the Project no longer intends to transport water for discharge into the Missouri River. This will release the Project from having to obtain a specific NPDES water quality discharge permit from the State of Nebraska, as well as an additional Section 404 permit, and a Section 408 permit, from the U.S. Army Corps of Engineers. The Section 408 permit would have required completion of an Environmental Assessment study, a process that is governed by the National Environmental Policy Act (“NEPA”) and involves review by multiple federal government agencies.

— Additional Protection of Groundwater Resources Through Artificial Ground Freezing: The Project’s new mine plan will utilize artificial ground freezing as part of the process of sinking the Project’s production and ventilation shafts. Artificial ground freezing creates a temporary frozen barrier that helps to protect groundwater resources in the area while shaft-sinking operations are underway.

— Avoidance of Permanent Impacts to Federally Jurisdictional Waters: NioCorp designed the layout of the Elk Creek Project to minimize or avoid permanent impacts to any federally jurisdictional waters and/or wetlands on the property. This reduced the Project’s expected environmental impacts and allowed the Project to secure a Clean Water Act Section 404 permit from the U.S. Army Corps of Engineers under the Nationwide Permit program, a much more efficient and less expensive process than an individual Section 404 permit. No other NEPA-level federal permits are now expected to be required for the Project.

— Recycling of Reagents Used in Mineral Processing: Metallurgical and process breakthroughs that NioCorp accomplished in 2016 and 2017 (see this previous announcement) are expected to help reduce the volume of material planned for disposal in the Project’s tailings storage areas. As more of this material is recycled, the environmental footprint of the Project is reduced.

— Utilizing Tailings as Underground Mine Backfill: NioCorp plans to fill underground voids concurrently with mining operations using a paste backfill material that contains mine waste material that typically would be stored in above-ground mine tailings storage areas.

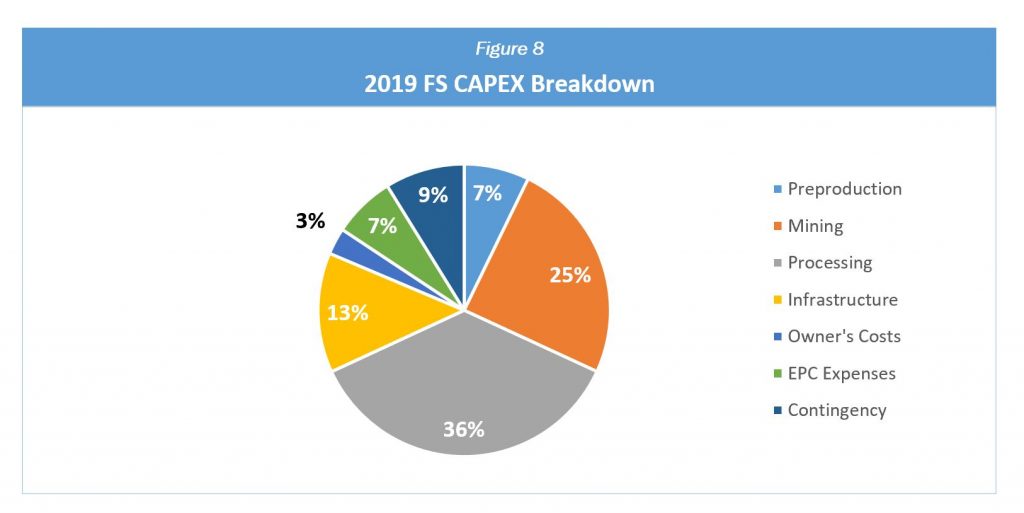

Capital Expenditures (“CAPEX”)

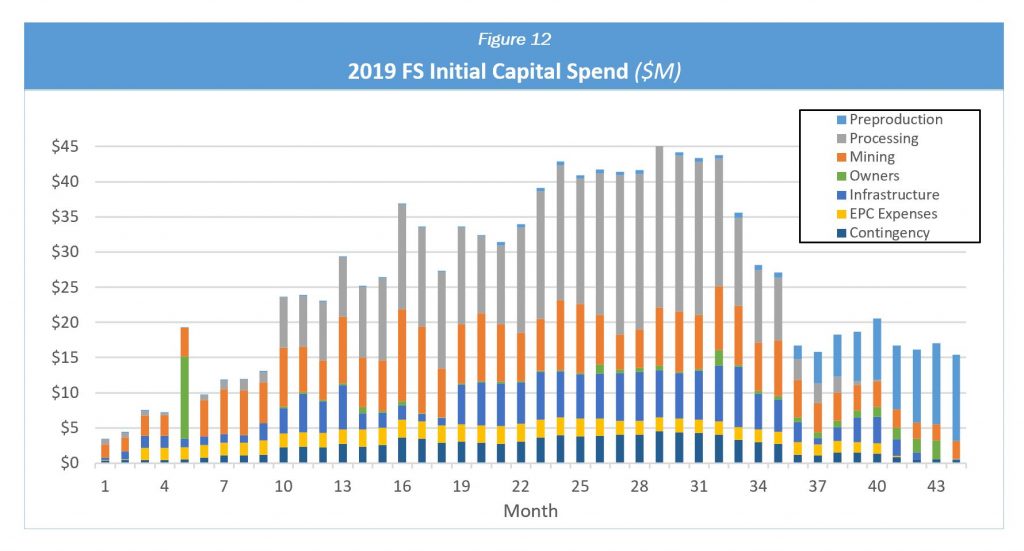

As detailed in Table 6 below, the net pre-production CAPEX is $879 million, which includes a contingency of 10.33%6 and a pre-production net revenue credit of $265 million, which is generated during a six-month production ramp-up period (versus a three-month ramp-up in the 2017 FS) and is net of pre-production capital and operational costs. Total upfront CAPEX for the Project is $1.14 billion, a 5.1% increase over the 2017 FS and which reflects the following: additional and larger water treatment equipment; higher costs due to inflation between 2017 and 2019; replacing a ventilation raise system with a ventilation shaft sinking method using proven artificial ground freezing methods to mitigate water inflow risks for this requirement; and higher capital costs incurred by initially mining at greater depths where ore grades are higher.

|

Table 6 |

|||

| (US $millions) | 2017 FS | 2019 FS | Change |

| Direct Costs | |||

| Preproduction CAPEX | $71 | $83 | 16.2% |

| Mining CAPEX | $179 | $257 | 44% |

| Processing CAPEX (excluding water treatment) | $343 | $367 | 7.1% |

| Water management CAPEX7 | $100 | $6 | -94% |

| Water Treatment8 | $24 | $68 | 180% |

| Tailings | $20.2 | $21.4 | 6.1% |

| Site prep | $30.6 | $40.6 | 2.6% |

| Indirect Expenses | |||

| Mining | $21.9 | $23.7 | 8.1% |

| Mining EPC | $12.3 | $16.0 | 30% |

| Processing | $34.1 | $33.4 | -1.8% |

| Processing EPC | $64.5 | $62.6 | -2.9% |

| Site | $7.2 | $7.4 | 2.7% |

| Water management9 | $10.8 | $8.5 | -20.8% |

| Owners Costs | $38.4 | $33.6 | -12.4% |

| Commissioning | |||

| Mining | $0.7 | $1.4 | 102% |

| Processing | $13.0 | $13.3 | 2.7% |

| Contingency | $109 | $101 | -7.3% |

| Sub Total | $1,088 | $1,143 | 5.1% |

| Net Pre-Production Revenue | ($79) | ($265) | 234% |

| TOTAL | $1,008 | $879 | -12.9% |

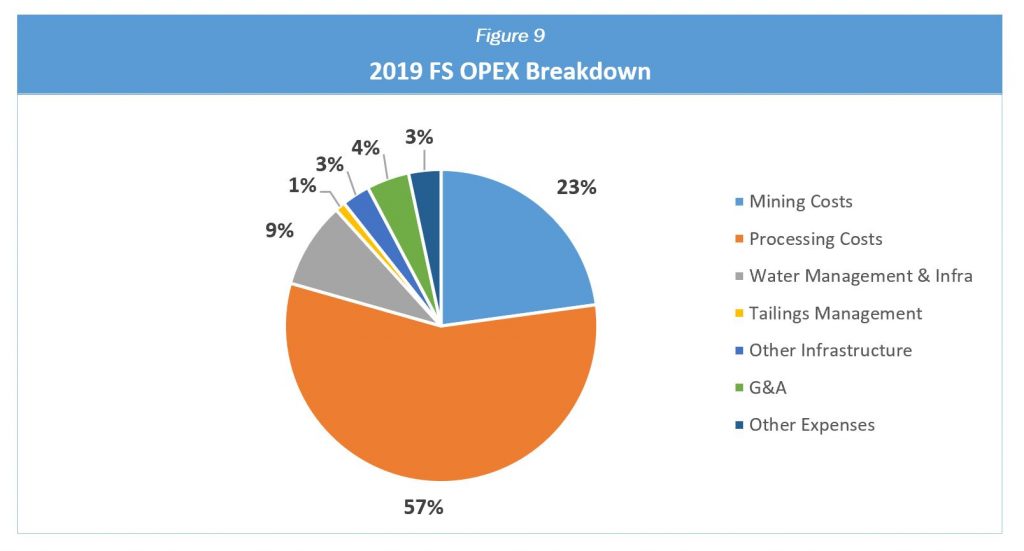

Operating Expenditures (“OPEX”)

Operating expenditures over the life of mine in the 2019 FS are higher than the 2017 FS as a result of several factors, including but not limited to the following: (1) NioCorp intends to use a contract mining model as opposed to self-perform mining operations; (2) prices for some consumables used in surface processing facilities are higher than quotes received in 2017; and (3) water management costs for the Project are higher as a result of the more intensive water treatment and related operations outlined in the 2019 FS.

|

Table 7 |

||||||||

| 2017 FS | 2019 FS | |||||||

| LoM Costs ($millions) |

Cost / Tonne | LoM Costs ($millions) |

Cost / Tonne | |||||

| LoM Operating Costs | ||||||||

| Mining Costs | $1,244 | $39.30 | $1,563 | $43.04 | ||||

| Processing Costs | $3,285 | $103.77 | $3,875 | $106.70 | ||||

| Water Management & Infra | $251 | $7.92 | $609 | $16.78 | ||||

| Tailings Management | $46 | $1.44 | $72 | $1.99 | ||||

| Other Infrastructure | $212 | $6.68 | $199 | $5.47 | ||||

| G&A | $268 | $8.47 | $301 | $8.29 | ||||

| Other Expenses | $136 | $4.31 | $229 | $6.30 | ||||

| Subtotal OPEX | $5,442 | $171.89 | $6,847 | $188.56 | ||||

| Royalties/Annual Bond Premium | $257 | $8.10 | $285 | $7.84 | ||||

| Total All-In OPEX | $5,699 | $179.99 | $7,132 | $196.41 | ||||

Financial Performance

The financial performance and valuation of the Project were conducted using a discounted cash flow (DCF) methodology over its 36-year mine life and an 8% discount rate. The 2019 FS projects a pre-tax NPV of $2.57 billion and an after-tax IRR of 25.8%. Gross revenue is $20.8 billion.

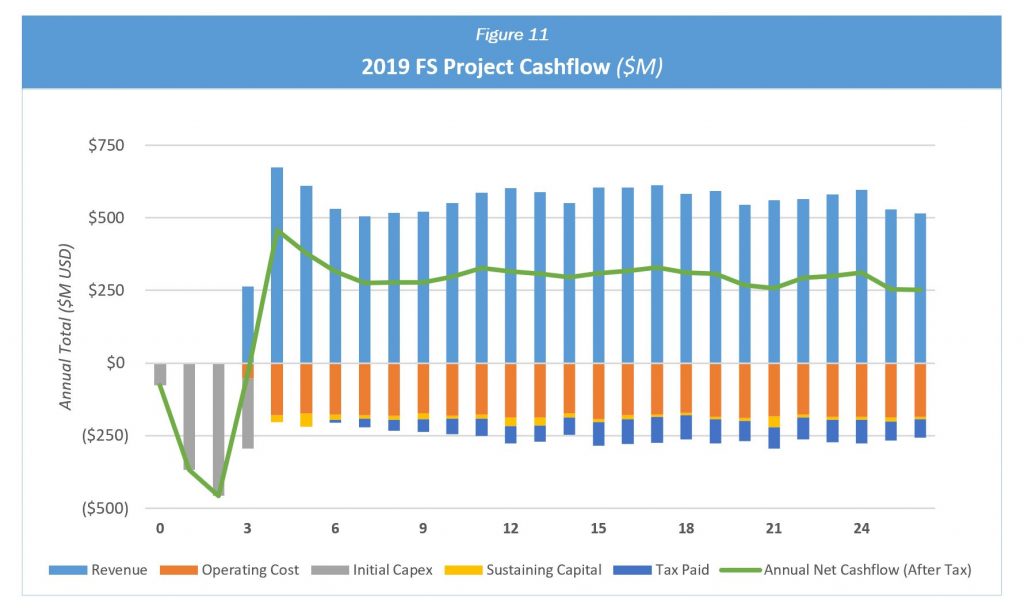

Figure 11 below shows the total cumulative net cash flow (after tax) over the 36 modeled life of mine. Total cumulative net cash flow, after tax, is $9.8 billion. Figure 12 below shows the initial capital spend over the first 44 months of the Project.

Sensitivity Analysis

A sensitivity analysis was conducted as part of the 2019 FS to determine the effect of key variables at a plus-or-minus 30% on the Project’s base case of pre-tax NPV of $2.57 billion and IRR of 27.3% and a base case of after-tax NPV of $2.10 billion and IRR of 25.8%. The results of this analysis are shown below in Tables 8 and 9.

|

Table 8 |

|||||||||||||

| Pre-Tax-NPV | -30% | -25% | -20% | -15% | -10% | -5% | Base | 5% | 10% | 15% | 20% | 25% | 30% |

| Nb Price | $1,947 | $2,050 | $2,153 | $2,256 | $2,359 | $2,462 | $2,564 | $2,667 | $2,770 | $2,873 | $2,976 | $3,079 | $3,182 |

| Sc2O3 Price | $1,560 | $1,728 | $1,895 | $2,062 | $2,230 | $2,397 | $2,564 | $2,732 | $2,899 | $3,066 | $3,234 | $3,401 | $3,568 |

| TiO2 Price | $2,531 | $2,537 | $2,542 | $2,548 | $2,553 | $2,559 | $2,564 | $2,570 | $2,575 | $2,581 | $2,586 | $2,592 | $2,597 |

| Operating Costs | $3,086 | $2,999 | $2,912 | $2,825 | $2,738 | $2,651 | $2,564 | $2,478 | $2,391 | $2,304 | $2,217 | $2,130 | $2,043 |

| Capital Costs | $2,913 | $2,855 | $2,797 | $2,739 | $2,681 | $2,622 | $2,564 | $2,506 | $2,448 | $2,390 | $2,332 | $2,274 | $2,216 |

| Pre-Tax IRR | -30% | -25% | -20% | -15% | -10% | -5% | Base | 5% | 10% | 15% | 20% | 25% | 30% |

| Nb Price | 23.2% | 23.9% | 24.6% | 25.3% | 26.0% | 26.7% | 27.3% | 28.0% | 28.7% | 29.3% | 30.0% | 30.7% | 31.3% |

| Sc2O3 Price | 20.3% | 21.5% | 22.7% | 23.9% | 25.1% | 26.2% | 27.3% | 28.5% | 29.6% | 30.7% | 31.8% | 32.8% | 33.9% |

| TiO2 Price | 27.1% | 27.2% | 27.2% | 27.2% | 27.3% | 27.3% | 27.3% | 27.4% | 27.4% | 27.5% | 27.5% | 27.5% | 27.6% |

| Operating Costs | 30.6% | 30.1% | 29.6% | 29.0% | 28.5% | 27.9% | 27.3% | 26.8% | 26.2% | 25.6% | 25.1% | 24.5% | 23.9% |

| Capital Costs | 37.7% | 35.5% | 33.5% | 31.7% | 30.1% | 28.7% | 27.3% | 26.1% | 25.0% | 24.0% | 23.0% | 22.2% | 21.3% |

|

Table 9 |

|||||||||||||

| After Tax NPV | -30% | -25% | -20% | -15% | -10% | -5% | Base | 5% | 10% | 15% | 20% | 25% | 30% |

| Nb Price | $1,594 | $1,678 | $1,763 | $1,847 | $1,932 | $2,016 | $2,098 | $2,180 | $2,262 | $2,343 | $2,425 | $2,506 | $2,588 |

| Sc2O3 Price | $1,292 | $1,427 | $1,562 | $1,697 | $1,832 | $1,966 | $2,098 | $2,228 | $2,357 | $2,486 | $2,615 | $2,744 | $2,872 |

| TiO2 Price | $2,072 | $2,076 | $2,081 | $2,085 | $2,089 | $2,094 | $2,098 | $2,103 | $2,107 | $2,111 | $2,116 | $2,120 | $2,124 |

| Operating Costs | $2,480 | $2,417 | $2,353 | $2,290 | $2,226 | $2,162 | $2,098 | $2,034 | $1,967 | $1,900 | $1,833 | $1,767 | $1,699 |

| Capital Costs | $2,446 | $2,388 | $2,330 | $2,272 | $2,214 | $2,156 | $2,098 | $2,040 | $1,982 | $1,924 | $1,866 | $1,808 | $1,750 |

| After Tax IRR | -30% | -25% | -20% | -15% | -10% | -5% | Base | 5% | 10% | 15% | 20% | 25% | 30% |

| Nb Price | 21.9% | 22.6% | 23.3% | 23.9% | 24.6% | 25.2% | 25.8% | 26.4% | 27.0% | 27.6% | 28.2% | 28.8% | 29.4% |

| Sc2O3 Price | 19.3% | 20.5% | 21.6% | 22.7% | 23.7% | 24.8% | 25.8% | 26.8% | 27.8% | 28.8% | 29.8% | 30.7% | 31.7% |

| TiO2 Price | 25.6% | 25.6% | 25.7% | 25.7% | 25.7% | 25.8% | 25.8% | 25.8% | 25.9% | 25.9% | 25.9% | 26.0% | 26.0% |

| Operating Costs | 28.7% | 28.2% | 27.7% | 27.3% | 26.8% | 26.3% | 25.8% | 25.3% | 24.8% | 24.3% | 23.8% | 23.3% | 22.8% |

| Capital Costs | 36.3% | 34.1% | 32.1% | 30.3% | 28.6% | 27.2% | 25.8% | 24.6% | 23.5% | 22.4% | 21.5% | 20.6% | 19.8% |

Mineral Resource Estimate Update

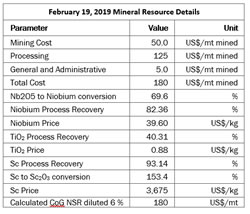

A component of the 2019 FS update included an update to the Project’s Mineral Resource and Mineral Reserve, with the results shown below.

|

Table 10 |

||||||||

| Classification | Cut-off NSR (DIL)(US$/mt) |

Tonnage (x1000 mt) |

Nb2O5 Grade (%) |

Contained Nb2O5 (mt) |

TiO2 Grade (%) |

Contained TiO2 (mt) |

Sc Grade (ppm) |

Contained Sc (mt) |

| Indicated | 180 | 183,185 | 0.54 | 981,092 | 2.15 | 3,940,419 | 57.65 | 10,562 |

| Inferred | 180 | 103,992 | 0.48 | 498,864 | 1.81 | 1,886,181 | 47.38 | 4,928 |

Source: Nordmin, 2019. All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding.

- Mineral resources are reported inclusive of the mineral reserve. Mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate and have been used to derive sub-totals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, Nordmin does not consider them to be material.

- The reporting standard adopted for the reporting of the MRE uses the terminology, definitions and guidelines given in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves (May 10, 2014) as required by NI 43-101.

- CIM definition standards for mineral resources and mineral reserves (May 2014) defines a mineral resource as:

- “(A) concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge”.

- Historical samples have been validated via re-assay programs, and all drilling completed by NioCorp has been subjected to QA/QC. All composites have been capped and then composited where appropriate, and estimates completed used ordinary kriging. The concession is wholly owned by and exploration is operated by NioCorp Developments Ltd.

- The project is amenable to underground longhole open stoping mining methods. Using results from metallurgical test work, suitable underground mining and processing costs, and forecast product pricing Nordmin has reported the mineral resource at an NSR cut-off of US$180/mt.

- Economic Assumptions Used to Define Mineral resource Cut-off Value:

Diluted NSR (US$) = Revenue per block Nb2O5 (diluted) + Revenue per block TiO2 (diluted) + Revenue per block Sc (diluted)

Diluted tonnes per block

- Price assumptions for FeNb, Sc2O3, and TiO2 are based upon independent market analyses for each product.

- Price and cost assumptions are based on the pricing of products at the “mine-gate”, with no additional down-stream costs required. The assumed products are a ferroniobium product (metallic alloy shots 0.65Nb0.35% Fe), a titanium dioxide product in powder form, and scandium trioxide in powder form.

- The “reasonable prospects for economic extraction” requirement generally implies that the quantity and grade estimates meet certain economic thresholds and that the mineral resources are reported at an appropriate Cut-off Grade (“CoG”), considering extraction scenarios and processing recoveries. Based on this requirement, Nordmin considers that major portions of the project are amenable for underground extraction with a processing method to recover FeNb (as the saleable product of Nb2O5), TiO2, and Sc2O3 products.

- The result of positive indications from the company’s metallurgical testing and development program, titanium (TiO2) and scandium (Sc) were added to the mineral resource Statement in February 2015. Both metals can be recovered with simple additions to the existing process flowsheet and would provide additional revenue streams that would complement the planned production of ferroniobium.

- Nordmin has provided reasonable estimates of the expected costs based on the knowledge of the style of mining (underground) and potential processing methods (by 3rd party Qualified Persons).

- Mineral Resource effective date February 19, 2019.

- Nordmin completed a site inspection of the deposit by Glen Kuntz, BSc, P.Geo., Consulting Specialist – Geology/Mining, an appropriate “independent qualified person” as this term is defined in NI 43-101.

Mineral Reserve Estimate Update

An update to the Project’s Mineral Reserve was conducted, and the results are shown below.

|

Table 11 |

||||||||||

| Classification | Tonnage (x1000 mt) |

Nb2O5 Grade (%) |

Contained Nb2O5 (mt) |

Payable Nb (mt) |

TiO2 Grade (%) |

Contained TiO2 (mt) |

Payable TiO2 (mt) |

Sc Grade (ppm) |

Contained Sc (mt) |

Payable Sc2O3 (mt) |

| Proven | ||||||||||

| Probable | 36,313 | 0.81 | 293,321 | 168,861 | 2.86 | 1,039,050 | 418,841 | 65.7 | 2,387 | 3,410 |

| Total Proven and Probable | 36,313 | 0.81 | 293,321 | 168,861 | 2.86 | 1,039,050 | 418,841 | 65.7 | 2,387 | 3,410 |

Source: Nordmin, 2019. All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding.

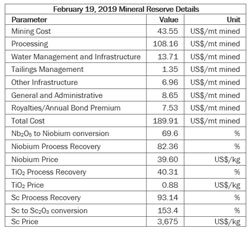

- Nordmin has reported the mineral reserve based on the mine design, mine plan, and cash-flow model utilizing an average cut-off grade of 0.788% NB205 with an NSR of $500/mt.

- Nordmin considers that the mineral reserve is amenable for underground extraction with a processing method to recover FeNb (as the saleable product of Nb2O5), TiO2, and Sc2O3products.

- The economic assumptions used to define Mineral Reserve cut-off grade are as follows:

- Annual life of mine (LoM) production rate of ~7,220 tonnes of FeNb/annum,

- Initial elevated five-year production rate ~ 7,351 tonnes of FeNb/annum

- Mining dilution of ~6% was applied to all stopes and development, based on 3% for the primary stopes, 9% for the secondary stopes, and 5% for ore development.

- Mining recoveries of 95% were applied.

- Price assumptions for FeNb, Sc2O3, and TiO2 are based upon independent market analyses for each product.

- Price and cost assumptions are based on the pricing of products at the “mine-gate”, with no additional down-stream costs required. The assumed products are a ferroniobium product (metallic alloy shots 0.65Nb0.35% Fe), a titanium dioxide product in powder form, and scandium trioxide in powder form.

- Annual life of mine (LoM) production rate of ~7,220 tonnes of FeNb/annum,

- The mineral reserve has an average LoM NSR of $538.63 /tonne.

- Nordmin has provided detailed estimates of the expected costs based on the knowledge of the style of mining (underground) and potential processing methods (by 3rd party Qualified Persons).

- Mineral Reserve effective date February 19, 2019. The financial model was run post-February 2019, which reflects a total cost of $196.41 (Table 7) versus $189.91 (February 19, 2019 Mineral Reserve Details Table above). Nordmin does not consider this a material change.

- Price variances for commodities is based on updated independent market studies versus earlier projected pricing. The updated independent market studies do not have a negative effect on the reserve.

- Nordmin completed a site inspection of the deposit by Jean- Francois St-Onge, P.Eng, Associate Consulting Specialist – Mining, an appropriate “independent qualified person” as this term is defined in NI 43-101.

Next Steps

— File the updated NI-43-101 Technical Report for the Project on SEDAR within the next 45 days and post on www.niocorp.com.

— Secure project finance necessary to move the Project to construction and commercial operation.

— Submit a construction air permit application to the State of Nebraska, along with other permit applications that will be needed for construction.

— Make formal awards of Engineering, Procurement, and Construction contracts.

— Continue detailed engineering for the Project’s mine and surface facilities.

NioCorp Conference Call / Webcast on Monday, April 22, 2019

NioCorp will host a conference call and live webcast on Monday, April 22, 2019, starting at 10 a.m. Mountain, featuring Mark A. Smith, NioCorp’s CEO and Executive Chairman, and Scott Honan, President of Elk Creek Resources Corp., to discuss the results of the new Elk Creek mine plan, Feasibility Study update, and the Project’s newly updated Mineral Resource and Mineral Reserve.

Those wishing to participate in the live webcast, where presentation slides will be shown and questions can be submitted during the webcast, can register here: https://attendee.gotowebinar.com/register/6302297693868155395. Those wishing to participate via a listen-only phone line can use the call-in numbers and access codes listed below.

| COUNTRY | Listen-Only Call-In Number | Access Code |

| US | (213) 493-0005 | 433-576-565 |

| Australia | +61 3 8488 8990 | 433-576-565 |

| Austria | +43 7 2081 5389 | 433-576-565 |

| Belgium | +32 28 93 7003 | 433-576-565 |

| Canada | +1 (647) 497-9385 | 433-576-565 |

| Denmark | +45 32 72 03 72 | 433-576-565 |

| Finland | +358 923 17 0557 | 433-576-565 |

| France | +33 971 072 671 | 433-576-565 |

| Germany | +49 692 5736 7318 | 433-576-565 |

| Ireland | +353 15 360 755 | 433-576-565 |

| Italy | +39 0 230 57 81 73 | 433-576-565 |

| Netherlands | +31 202 251 018 | 433-576-565 |

| New Zealand | +64 4 974 7212 | 433-576-565 |

| Norway | +47 23 16 23 28 | 433-576-565 |

| Spain | +34 912 71 8490 | 433-576-565 |

| Sweden | +46 853 527 819 | 433-576-565 |

| Switzerland | +41 225 4599 62 | 433-576-565 |

| United Kingdom | +44 330 221 9922 | 433-576-565 |

Technical Disclosure

The technical information in this news release and the forthcoming FS update has been reviewed and approved by Mr. Chris Dougherty, P.Eng, Consulting Specialist and Chairman (Nordmin Group of Companies), Mr. Gregory Menard, P.Eng., CET, PMP, Senior Mechanical Engineer (Nordmin Engineering Ltd.) and Mr. Glen Kuntz, P.Geo., Consulting Specialist – Geology/Mining (Nordmin Engineering Ltd.), and Mr. Joshua Sames, B.S., PE, Senior Consultant (SRK Consulting), Mr. David Winters, PE, SE, MBA, Senior Consultant (TetraTech), each of whom is a “qualified person” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI-43-101”).

The Mineral Resource and Reserve Estimates were completed by Mr. Glen Kuntz, P. Geo, Consulting Specialist – Geology/Mining (Nordmin Engineering Ltd.) and Mr. Jean- Francois St-Onge, P.Eng, Associate Consulting Specialist – Mining and Vice President (Optimize Group Inc.). Both are independent Qualified Persons in accordance with the requirements of National Instrument (NI) 43-101 and they have approved the disclosure herein.

All other technical information in this news release has been approved by the following Qualified Professionals: Mr. Adrian Brown, PE, Consultant (Adrian Brown Consultants); Mr. Joshua Sames, B.S., PE, Senior Consultant (SRK Consulting); Mr. John Tinucci, PhD, PE, Principal Geotechnical Engineer (SRK Consulting); Mr. Mark Willow, M.Sc, C.E.M., SME-RM, Principal Environmental Scientist (SRK Consulting); Mr. Chris Dougherty, P.Eng, Consulting Specialist and Chairman (Nordmin Group of Companies); Mr. Gregory Menard, P.Eng., CET, PMP, Senior Mechanical Engineer (Nordmin Engineering Ltd.); Mr. Eric Larochelle, B.Eng., President (Specialty Metals & Hydrometallurgy); Mr. David Winters, PE, SE, MBA, Senior Consultant (TetraTech); Mr. Sylvain Harton, P.Eng., President (Metallurgy Concept Solutions); and Mr. Orest Romaniuk, P.Eng, Senior Engineer (Zachry Group).

The relevant qualified persons have reviewed and verified the data disclosed, including sampling, analytical and test data underlying the information contained in the disclosure.

Footnotes

1 See endnote regarding Mineral Reserve and Mineral Resource.

2 Net pre-production CAPEX includes a 10.33% contingency and a pre-production net credit of $265 million for revenue generated during the six-month production ramp-up period minus pre-production capital and operational costs.

3 See endnotes for discussion of the use of non-GAAP financial measures.

4 Source: U.S. Department of Labor, Bureau of Labor Statistics, March 2019 data.

5 “Run of Mine,” or ROM, is defined as the period of time during which the mine is fully operational and excludes the periods of time when the mine is conducting its initial production ramp or is ramping down to closure. “Life of Mine,” or LOM, encompasses the entire expected operational life of the mine, including ramp-up and ramp-down production periods.

6 Project contingency percentage is calculated on all features of the project excluding the water treatment plant, which is quoted on a design-build-operate basis and incorporates its own contingency.

7 Water management CAPEX of $100 million in the 2017 FS were primarily attributable to the cost of constructing the then-planned waterline to the Missouri River and costs associated with pre-production dewatering wells and hydrogeological investigations. 2019 water management CAPEX encompasses hydrogeological investigations.

8 Water treatment includes direct costs of the Project’s water treatment systems.

9 Indirect expenses for water management in the 2017 FS included hydrogeologic investigations and installation and testing of prototype water pumping wells. In the 2019 FS, these costs encompass the indirect costs of building the Project’s water treatment facility.

Endnotes

Non-GAAP Financial Measures: This news release includes certain forward-looking non-GAAP financial measures, including EBITDA and Free Cash Flow. These non-GAAP financial measures are included in this news release because these statistics are key performance measures that management uses to monitor performance, to assess how the Company is performing, to plan and to assess the overall effectiveness and efficiency of operations. These performance measures do not have a standard meaning within GAAP and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with GAAP. Reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of such items impacting comparability and the periods in which such items may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

SEC Standards Regarding Mineral Resources and Reserves. Estimates of mineralization and other technical information included or referenced in this news release have been prepared in accordance with NI 43-101. The definitions of proven and probable mineral reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. As a result, the reserves reported by the Company in accordance with NI 43-101 may not qualify as “reserves” under SEC standards. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Additionally, the disclosure of “contained pounds” in a resource

is permitted disclosure under Canadian securities laws; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements. Accordingly, information contained or referenced in this news release containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

# # #

@NioCorp $NB $NIOBF #Niobium #Scandium #ElkCreek #Nordmin

For More Information

Contact Jim Sims, VP of External Affairs, NioCorp Developments Ltd., 20-639-4650, [email protected]

About NioCorp

NioCorp is developing a superalloy materials project in Southeast Nebraska that will produce Niobium, Scandium, and Titanium. Niobium is used to produce superalloys as well as High Strength, Low Alloy (“HSLA”) steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a superalloy material that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium also is a critical component of advanced solid oxide fuel cells. Titanium is used in various superalloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor and medical implants.

Cautionary Note Regarding Forward-Looking Statements

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this document. Certain statements contained in this document may constitute forward-looking statements, including statements regarding the results of the feasibility study, including, but not limited to, metal price and exchange rate assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates; the Company’s potential plans and operating performance; the estimation of the tonnage, grades and content of deposits, and the extent of the resource and reserves estimates; potential production from and viability of the Project; the future ability to obtain permits and the nature of the permits required; estimates of future production and operating costs; improvements in environmental performance and the reduction in environmental impacts; estimates of permitting submissions and timing; the timing and receipt of necessary permits and project approvals for future operations; access to project funding, exploration results, and expected filing of the NI 43-101 Technical Report. Such forward-looking statements are based upon NioCorp’s reasonable expectations and business plan at the date hereof, which are subject to change depending on economic, political and competitive circumstances and contingencies. Readers are cautioned that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause a change in such assumptions and the actual outcomes and estimates to be materially different from those estimated or anticipated future results, achievements or position expressed or implied by those forward-looking statements. Risks, uncertainties and other factors that could cause NioCorp’s plans or prospects to change include risks related to the Company’s ability to operate as a going concern; risks related to the Company’s requirement of significant additional capital; changes in demand for and price of commodities (such as fuel and electricity) and currencies; changes in economic valuations of the Project, such as Net Present Value calculations, changes or disruptions in the securities markets; legislative, political or economic developments; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp’s projects; risks of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business and the risks set forth in the Company’s filings with Canadian securities regulators at www.sedar.com and the SEC at www.sec.gov. NioCorp disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.