April 28, 2017

By Mark A. Smith, P.E., Esq.

Executive Chairman and CEO

NioCorp Developments Ltd.

As I view the future landscape for the mining, alloys, and advanced materials sectors, one set of demand drivers stands out: the growing imperative to lightweight transportation, buildings, and infrastructure systems.

Interest in lighter, more fuel efficient, and environmentally friendly products is growing because “lightweighting” delivers measurable benefits, such as: better fuel economy; lower lifecycle costs; longer-lived and more corrosion resistant products; fewer environmental impacts; and healthier returns on public sector spending. The list goes on.

Governments are driving lightweighting efforts with even more force than consumer markets. Much of this is tied to regulators’ desire to force reductions in air pollution. Pick your molecule of concern – carbon dioxide, methane, nitrogen oxides, volatile organic compounds – lightweighting can deliver large emissions reductions, and relatively quickly.

Virtually everyone – including those who remain skeptical of anthropogenic climate change – agrees with this: pumping fewer tons of manmade emissions into the air we breathe is a worthwhile goal. If this can be done economically, while maintaining the attendant rewards of better energy efficiency, reduced fuel consumption, robust job creation, and a better bang for the U.S. taxpayer buck, that proposition becomes pretty compelling.

Governments are also increasingly interested in seeing more lightweight materials used in multi-billion-dollar infrastructure rebuilding programs. Not only do lighter-weight materials reduce environmental impacts, but “super steels” and high-performance alloys made with metals such as niobium, scandium, vanadium, and others dramatically extend the working lifespan of roads, bridges, airports, and other infrastructure projects. That delivers a much larger bang for each taxpayer buck spent.

All of these trends tell me that we are on the cusp of a multi-decade global lightweighting revolution, and one that promises significant returns for those who produce or invest in the metals, alloys, and advanced materials that make this revolution possible.

Lightweighting: A Key to Future Efficiency and Environmental Gains in Vehicles

The transportation sector has been the primary focus of lightweighting efforts to date, and for good reason. According to the U.S. Environmental Protection Agency (EPA), it is one of the major sector contributors to the nation’s overall emissions of NOx, VOCs, and other air emissions, and is responsible for about 34% of all greenhouse gas (GHG) emissions in the U.S. Globally, more than 1.2 billion passenger cars and commercial vehicles operate on the planet today. That is a lot of emissions generators.

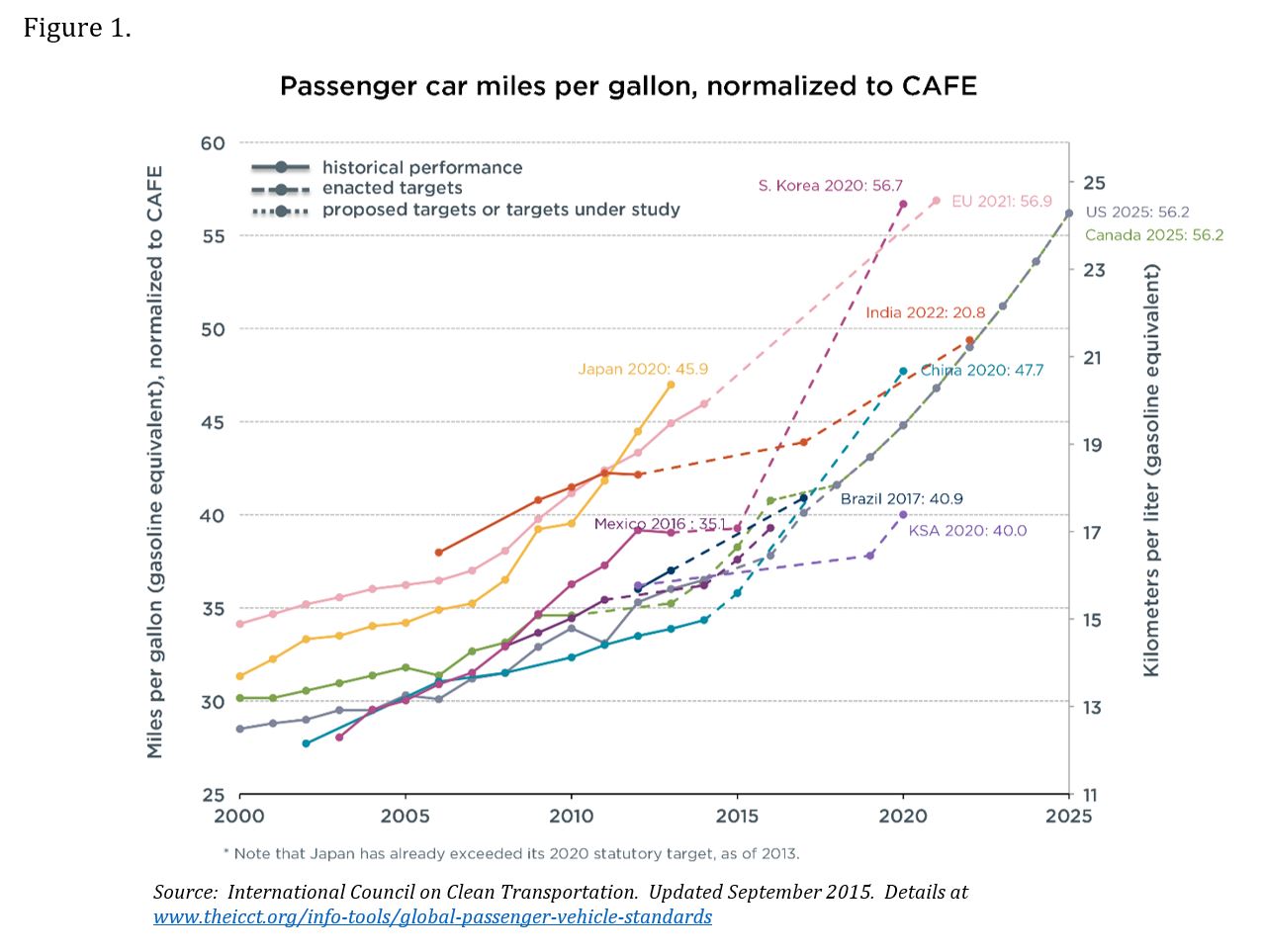

Governments are pushing vehicle manufacturers to increase their fleet-wide fuel economy standards as a means of reducing emissions-per-mile. The most recent proposal for the next round of Corporate Average Fuel Economy (CAFE) standards in the U.S. sets a target on an average industry fleet-wide basis of 163 grams/mile of carbon dioxide (CO2) in model year 2025. How does that translate to a miles-per-gallon (MPG) target? It is equivalent to 54.5 MPG if the vehicles were to meet this CO2 level all through fuel economy improvements.

Targets in the EU are even tougher: a reduction from 130 grams of CO2 per kilometer in 2015 to 95 grams per kilometer by 2021. In fact, nearly all developed nations have set similar stretch goals for average fleet-wide vehicle fuel economy. Regardless of whether or not these fuel efficiency standards continue to be measured in terms of CO2 reductions, they are almost certain to be pushed higher. See Figure 1.

What materials are used in vehicle lightweighting? Carbon fiber, aluminum alloys, glass-fiber reinforced polymer composites, and high-strength, low-alloy steel (HSLA), to name a few. In particular, HSLA steel is gaining increased attention, largely because of its ability to reduce vehicle mass while also increasing the vehicle’s strength and its safety envelope. According to the U.S. Department of Energy, replacing cast iron and traditional steel components with HSLA steels can reduce a vehicle’s mass by up to 50 percent, with commensurate improvements in fuel efficiency and fewer emissions. That’s a compelling return.

HSLA steel is made by adding small amounts of niobium and/or vanadium to carbon steel. Other additives can include manganese, copper, nickel, nitrogen, chromium, molybdenum, titanium, calcium, and zirconium, among others.

Here’s an example that is admittedly near and dear to my heart: one quarter of a kilogram of niobium added to steel in a mid-sized passenger vehicle allows for a reduction in the overall weight of the vehicle by about 100 kilograms. That, in turn, increases its fuel efficiency by five percent. That may not sound like much to the average consumer who is value shopping in their local auto dealer. But multiply that increased fuel efficiency by hundreds of millions of vehicles, and we’re suddenly talking about very large and quickly achievable emissions reductions.

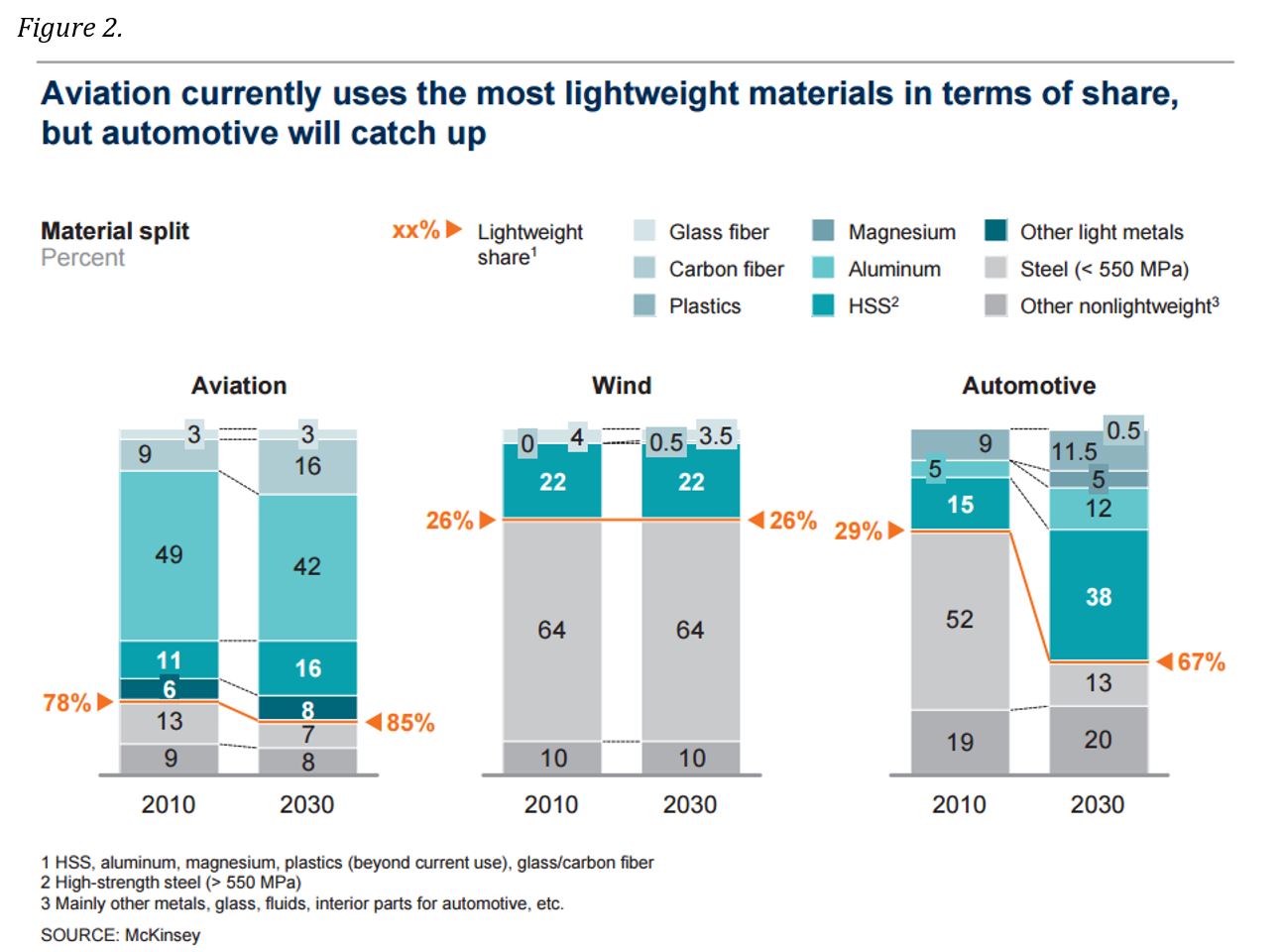

Which of the major lightweighting metals and materials are likely to see the greatest demand gains? It’s difficult to say at this point. However, a 2012 study by McKinsey estimated that the share of HSLA and advanced steels as percent of all construction material in vehicles will grow by 67 percent from 2010 to 2030, more than any other material studied. See Figure 2.

Clearly, those elements that are combined with steel and aluminum to make strong and lightweight alloys appear to have a very bright future in automotive sector lightweighting.

Lightweighting in Aviation: A Large Role for Scandium?

Speaking of metals that alloy with aluminum, the aviation industry has long been a leader in lightweighting, largely because of its ability to utilize lighter weight metals such as aluminum. This is a sector where metals such as scandium are poised to take things to a new level.

Scandium does for aluminum what niobium and vanadium do for steel. It gives superplasticity to aluminum alloys, which allows them to survive higher strain and bending forces. Those are crucial engineering requirements for aerospace applications.

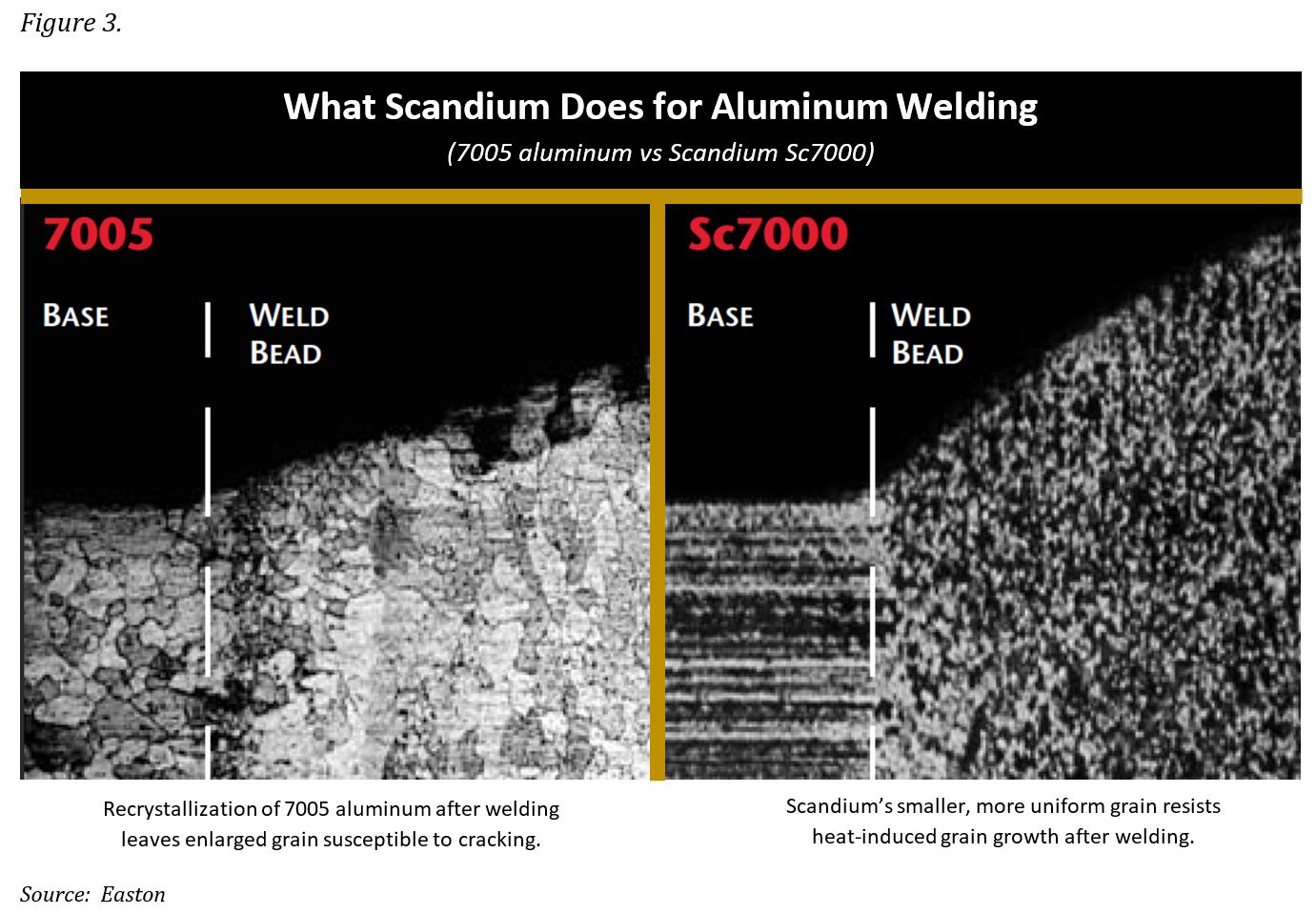

Scandium also allows for more dependable welding of aluminum in high-performance applications. It enables a finer alloy grain size and minimizes recrystallization in a weld’s heat-affected zone. See Figure 3. Aluminum alloys with less than one percent scandium content can eliminate the need for air frame rivets. That would be a revolutionary advance in commercial aircraft manufacture and operations.

Not surprisingly, several major aircraft manufacturers have been examining the potential use of scandium-contained aluminum alloys. Some have already invested in the development of prototype alloy parts. There are hundreds of patent filings and/or approvals related to scandium-contained aluminum alloys.

So, what’s holding the industry back from wide-scale deployment of scandium? In one word, supply. The entire world produces only 10-15 tonnes of scandium trioxide annually. Most of that is consumed in the solid oxide fuel cell industry, with some going into scandium alloys used in sporting goods, and smaller amounts going into lighting and other applications.

In my view, scandium is one element where the old adage applies: if you build it, they will come. It’s also why a company like NioCorp (TSX:NB), as the world’s largest prospective scandium producer, welcomes the advent of production by multiple scandium producers in Western nations. The 97 tonnes/year of scandium trioxide that NioCorp plans to produce is likely to be readily consumed, given that independent estimates peg latent demand for scandium trioxide in the aviation and fuel cell industries alone at several hundred tonnes per year.

In short, the world needs more scandium than NioCorp will be able to produce at our planned production rates. Multiple sources of supply also will help to de-risk use of this material by downstream consumers.

Lightweighting and Mega-Steel Infrastructure

The lightweighting revolution won’t be constrained to transportation. Mega-steel infrastructure projects are also headed in this direction.

Advanced steels are allowing for higher wind turbines towers, which increases their energy generating efficiency. They also enable the manufacture of lighter weight towers. On a per-installed megawatt basis, wind tower weights have declined by about 50% during the past 10 years. That reduces the per-unit emissions generated in manufacturing.

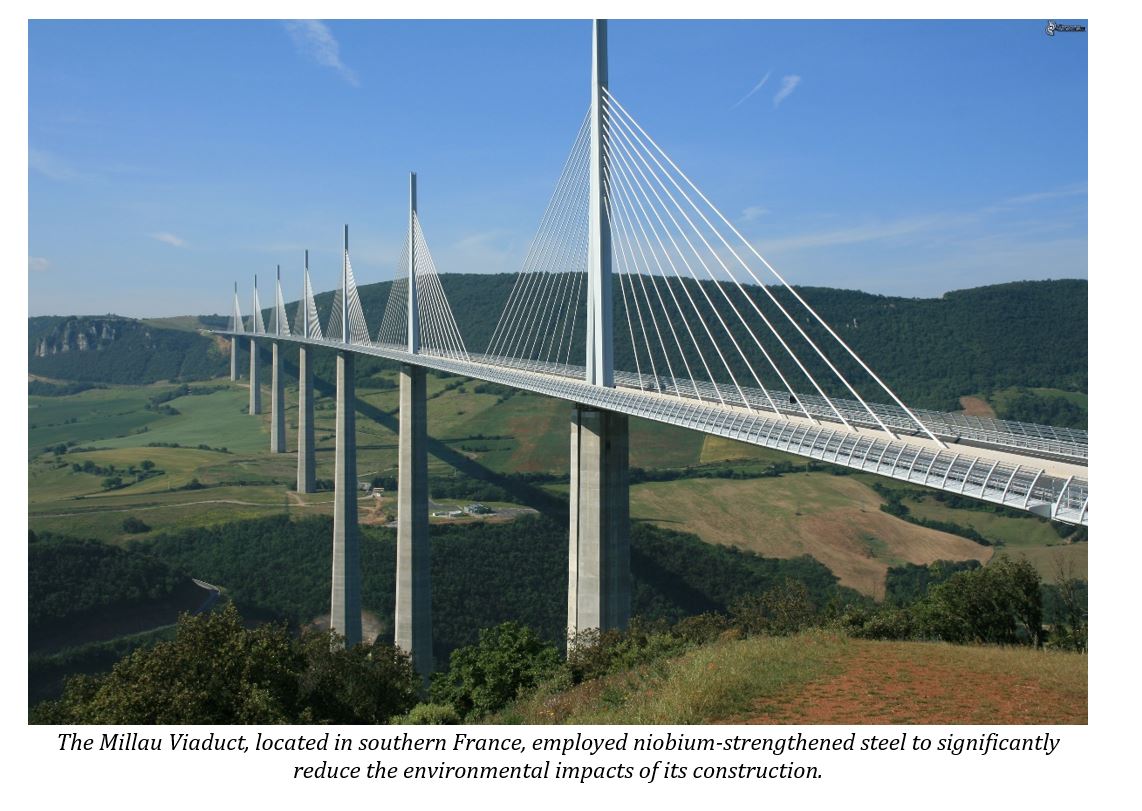

The world’s tallest bridge structure, located in the south of France, is known as the Millau Viaduct. It was built with HSLA steel that contained 0.025% of niobium. That small amount of niobium strengthened the steel to a degree that it allowed for an engineering design that required 60 percent less steel and concrete. When I first heard of this result, I asked some engineers to verify that this was in the realm of possibility. Their response: yes, HSLA steel with niobium, vanadium, and other alloying agents can achieve these dramatic results.

The ability of these materials to significantly improve the lifespan of mega-steel infrastructure is a deliverable that likely will be Washington, D.C.’s radar screen soon.

There are no reliable estimates yet of the market opportunity for steel and steel additives (and many other metals and construction materials) presented by this initiative. But I believe it is a reasonable bet that U.S. policymakers will be inclined to encourage the use of lightweighting materials where it makes commercial sense — if nothing other than because of the lifespan benefits. That delivers a much better bang for the taxpayer buck.

In summary, I see the lightweighting revolution serving as a powerful demand driver for the mining, alloy, and advanced materials industries. Lightweighting encompasses dozens of elements. It spans dozens of industries. It offers environmental benefits that are both measurable and near-term. It promises economic benefits to manufactures and consumers alike. And, it will appeal to a wide range of government on the political left and right.

Our industries are extraordinarily well positioned to help drive this revolution, and to benefit from it. By providing the fundamental building blocks of a cleaner and more fuel-efficient economy, we can show how doing well for the environment can also be very good for business

_____________________________

Mark A. Smith, a professional engineer and attorney, is CEO and Executive Chairman of NioCorp Developments Ltd., which is developing the Elk Creek, Nebraska Superalloy Materials Project.