2015: A Year of Exceptional Progresshe

NioCorp made excellent progress in 2015 to move its flagship Elk Creek, Nebraska niobium-scandium-titanium project closer to commercial operation. The summary below outlines just how far this amazing project has progressed in a relatively short timeframe.

NioCorp was one of the few companies in 2015 in North America that was able to attract significant project capital for a greenfield minerals development project. That’s largely due to the many factors that differentiate this project from the rest of the field. As the independent investment analysts at Rodman & Renshaw recently noted: “While commodity markets have been floundering, NioCorp has continued to progress its wholly-owned Elk Creek Project located in Nebraska while keeping a strong treasury… Elk Creek as a rare, strategic asset in a mining friendly jurisdiction.”

Elk Creek’s speed of development also sets it apart. The work completed by the NioCorp team in less than two years takes many junior mining companies between five to seven years to complete.

Looking forward, 2016 promises to be an even bigger year for the Company. NioCorp expects to issue its Elk Creek Feasibility Study in 2016, launch a global effort to secure project capital, and begin construction of its mine and processing facility.

|

Moving Elk Creek to Commercial Reality

When the Elk Creek Project’s Feasibility Study effort kicked off in May 2014, the only information available was assay data from some historic drillholes. Since that time, not only has NioCorp defined and expanded its mineral resource, but it completed detailed investigations in a number of areas where little or no information had been generated previously. These include the following:

- Mineral processing and associated metallurgical testing

- Hydrometallurgical testing

- Pyrometallurgical testing

- Analysis of the geotechnical properties of the rock and soil in the area

- Surface and groundwater system characteristics

- Dynamics of the local climate, resources, infrastructure, and physiography

- Economics of the niobium, scandium, and titanium markets

- And many other data sets.

Additionally, the NioCorp team completed an enormous amount of work to further characterize and expand the value of the Elk Creek Resource. For example, it accomplished the following:

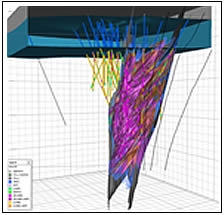

Completion of Phase III Drilling Program. In January of 2015, NioCorp released final results from its Phase III drilling program. In all, NioCorp’s drilling programs at Elk Creek have drilled a total of 18,735 meters (61,466 feet – the equivalent of more than 11.5 miles!). This program helped to establish the parameters of Elk Creek mineral resource.

Completion of numerous metallurgical development programs, including six lab-scale tests, eight pilot-scale tests, and more than 1,000 bench-scale tests.

Completion of a successful pyrometallurgical test program which produced ferroniobium that met a commercial product specification.

Issuance of a NI43-101 Resource Report Update. This update (“NI 43-101 Technical Report Updated Mineral Resource Estimate Elk Creek Niobium Project Nebraska,” dated February 20, 2015 and available on SEDAR) demonstrated a significant increase in the Indicated Mineral Resource when compared to an earlier assessment released in September 2014. For example, the Indicated Mineral Resource at Elk Creek was shown to be 80.5 million tonnes at a grade of 0.71% Nb2O5 (assuming a cut-off grade (CoG) of 0.3% Nb2O5). This compares to an estimate of 22.6 million tonnes at a grade of 0.70% Nb2O5 (using the same 0.3% CoG) in the September 2014 estimate. This is an increase in the contained Nb2O5% from 177,000,000 kg to 571,600,000 kg, or 187% increase in the Indicated tonnage or 226% within the contained Indicated Nb2O5.

Issuance of a Preliminary Economic Assessment Report (PEA1) in April 2015. This report showed very positive economic results from the Elk Creek development, including the following:

- Pre-tax NPV of US$875 million with a pre-tax IRR of 16.6%

- After-tax NPV of US$606 million with an IRR of 14.6%

- Average pre-tax cash flow of US$178 million

Issuance of an Updated PEA report (PEA2). The Company issued a second PEA Report on August 4, 2015, and further issued an updated and amended PEA report on October 16, 2015 (October 2015 PEA2). The October 2015 PEA2 report showed even stronger results1 from the Elk Creek Project, such as the following:

Issuance of an Updated PEA report (PEA2). The Company issued a second PEA Report on August 4, 2015, and further issued an updated and amended PEA report on October 16, 2015 (October 2015 PEA2). The October 2015 PEA2 report showed even stronger results1 from the Elk Creek Project, such as the following:

- Pre-tax NPV of US$3.07 billion, a 251% increase over PEA1

- Pre-tax IRR of 31.7%, a 91% increase over PEA1

- After-tax NPV of US$2.30 billion, a 248% increase over PEA1

- After-tax IRR of 27.6%, a 92% increase over PEA1

- Average pre-tax cash flow of US$438 million, a 146% increase over PEA1

- An increase in annualized Scandium Trioxide production to 97 tonnes, a 646% increase over PEA1

- Annualized Ferroniobium production of 7,490 tonnes

- Annualized Titanium Dioxide production of 23,960 tonnes

Please note that the Mineral Resource presented has been reported following CIM guidelines. The three PEA reports issued in 2015 are all preliminary in nature, and include a level of engineering precision and assumptions that are currently considered too speculative to have the economic considerations applied to them that would enable Mineral Resources to be categorized as Mineral Reserves. Inferred Mineral Resources are not included in the mine plan for these PEAs. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The PEAs includes price and market assumptions concerning an expanded demand in the scandium market. There is no certainty that the PEAs will be realized.

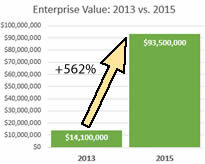

Mark Smith was named as NioCorp’s Chief Executive Officer in 2013. The Company’s enterprise value (equity value less cash plus total debt) stood at $14.1 million at the close of 2013. At the close of 2015, NioCorp’s enterprise value had grown to $93.5 million, a 562% increase over that two-year period.2

Lining Up Customers For Our Products

Just before the start of 2015, the Company negotiated an offtake agreement with ThyssenKrupp Metallurgical Products GmbH, whereby ThyssenKrupp will purchase approximately 3,750 metric tons or roughly fifty percent (50%) of NioCorp’s planned Ferro-Niobium production from its Elk Creek deposit for an initial ten year term, with an option to extend beyond that time-frame. The Agreement presupposes the Company obtaining project financing, obtaining all necessary approvals, and constructing a mine at Elk Creek.

NioCorp is engaged in active and continuing discussions with a variety of potential customers for its products. The Company expects to finalize offtake agreements in 2016 and beyond.

Attracting Investment Capital

In 2015, the Company was successful in raising a total of approximately US$14 million in debt and equity investments, including from institutional investors. These capital raises came in spite of a very difficult investment environment for those in the junior mining sector. NioCorp’s ability to attract capital when many other junior mining companies could not underscores the unique value proposition of the Company’s Elk Creek development.

Our capital raising efforts got off to a great start in 2016, as Niocorp announced on January 19, 2016 the successful close of an oversubscribed non-brokered equity financing for gross proceeds of approximately CAD$5.2 million.

Securing Eligibility for Potential Financing From The Federal Republic of Germany

Securing Eligibility for Potential Financing From The Federal Republic of Germany

In 2015, NioCorp obtained in-principle eligibility approval for a loan guarantee to be provided by the Federal Republic of Germany, which will support the Company’s debt financing strategy. This approval, the first of four approvals needed for such a loan guarantee, is based on NioCorp’s offtake agreement with ThyssenKrupp Metallurgical Products GmbH.

Management With Real Skin in the Game

As part of the US$14 million raised by NioCorp in 2015, Chairman and Chief Executive Officer Mark Smith invested a total of US$2.6 million in debt and equity in NioCorp in 2015. Mr. Smith now owns approximately 18.05 million shares of NioCorp common stock, which represents approximately a 10.75% ownership interest on an undiluted basis. This demonstrates our CEO’s rock-solid commitment to Company’s success and future growth.

A Top Performer on the TSX-V Exchange

In February 2015, NioCorp was named to the 2015 TSX Venture 50® as the mining sector’s top performing company. Not only was NioCorp’s overall ranking highest among mining companies, but the Company’s 420% stock price increase also was the largest percentage price increase of any TSX Venture 50® company, over all five industry sectors.

Graduating to the TSX from the TSX Venture Exchange

Graduating to the TSX from the TSX Venture Exchange

In March, the listing of NioCorp’s common shares moved to the Toronto Stock Exchange (TSX) from the TSX Venture Exchange. The TSX is a premier stock exchange for resource companies.

Working Out Mutually Beneficial Agreements with Area Landowners

In 2015, the Company concluded 15 land agreements covering mineral and/or surface rights across 1,216 acres of the Elk Creek project area. This encompasses the entire reported Elk Creek Mineral Resource. A portion of the reported Mineral Resource has been targeted for development at this stage by NioCorp, and is reflected in the Company’s October 2015 PEA2.

NioCorp has worked diligently to work out mutually beneficial arrangements with landowners in the area of the Elk Creek Project. Ensuring that the Project has strong support from local residents has been a top priority for the Company.

Building Broad-Based Political Support in Nebraska

Building Broad-Based Political Support in Nebraska

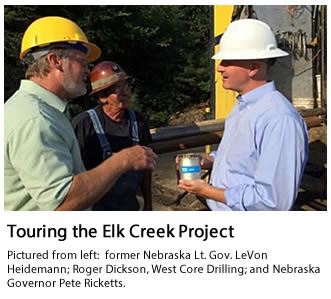

NioCorp maintained a strong focus in 2015 on stakeholder outreach so that a broad base of support for the Elk Creek Project is built and maintained. Such support is critical to success for any industrial metals development project. In 2015, Company officials conducted many dozens of meetings with various stakeholders in Nebraska, including state, county, local, and federal government officials, economic development advocates, area residents, investors, news media representatives, and many others.

The Company plans to conduct another Town Hall meeting with Elk Creek area residents in March 2016.

Expanding Our Highly Experienced Management Team

Expanding Our Highly Experienced Management Team

In 2015, the Company continued to strengthen its management team by making several key additions. In all, the current NioCorp management team now includes these highly experienced managers:

- Mark Smith, Board Chairman and Chief Executive Officer. With over 34 years of experience, Mr. Smith is well recognized in the mining community, having recently served as President, CEO and Director of Molycorp, Inc., where he was instrumentally involved in taking the company public. Prior to that, Mr. Smith was the President and CEO of Chevron Mining Inc. from 2005 through 2008. He was also Vice President for Unocal Corporation where he managed the real estate, remediation, mining and carbon divisions for over 22 years. From 2000 to 2007, Mr. Smith also served as a Director and Shareholder Representative of Companhia Brasileira de Metalurgia e Mineração (CBMM), a private company that currently produces approximately 85% of the world supply of Niobium. Mr. Smith is also currently serving as President, CEO and Director of Largo Resources (TSXv: LGO).

- John Ashburn, Vice President, General Counsel and Corporate Secretary. John is an attorney with over 35 years of experience, including 25 years in extractive industries. Most recently, Mr. Ashburn acted as Vice President, Chief Legal Officer and a member of the Board of Directors of Simbol, Inc., a privately held development stage Lithium production company. He previously served as Executive Vice President and General Counsel of Molycorp, Inc. and prior to that held senior legal positions with Chevron and Unocal Corporation. Mr. Ashburn holds a Juris Doctorate from Northern Illinois University, School of Law. Mr. Ashburn also currently serves as Chief Legal Officer and Corporate Secretary at Largo Resources (TSXv: LGO).

- Neal Shah, Interim Chief Financial Officer. Neal is a graduate of the University of Colorado’s Mechanical Engineering program (BSME) and Purdue University’s Krannert School of Management (MBA). With nearly 20 years of experience in various industries as diverse as high-tech to rare earth, his recent experience includes the positions of Senior Manager of Corporate Development and M&A and more recently the Director of Strategy and Business Planning at Molycorp’s corporate offices in Greenwood Village, CO. Previously, he was with Intel for six years, most recently as a Finance Manager in the high-growth wireless business group. Neal brings a wealth of corporate expertise having also worked at IBM, Boeing, and Covidien.

- Scott Honan, President, Elk Creek Resources Corporation and Vice President, Business Development, NioCorp Developments Ltd. Scott is a graduate of Queen’s University in Mining Engineering in both Mineral Processing (B.Sc. Honors) and Environmental Management (M.Sc.) disciplines. With over 22 years of experience in the niobium, base metals, gold and rare earth industries, his background includes the positions of General Manager and Environmental Manager at Molycorp’s Mountain Pass, CA facility, and more recently, Vice President Health, Environment, Safety and Sustainability at Molycorp.

- Jim Sims, Vice President, External Affairs. Jim manages investor relations, media relations, marketing, and government affairs for NioCorp. He has more than 25 years of experience in devising and executing marketing, media relations, public affairs, and investor relations operations for companies in the mining, chemical, manufacturing, utility, and renewable energy sectors. Most recently, he was Vice President of Corporate Communications for Molycorp, Inc., a mining and chemical processing company with more than 2,500 employees in 10 nations. From 1998-2010, he served as President and CEO of Policy Communications, Inc., where he led the corporate turnaround of the Western Business Roundtable and served as its CEO for eight years. The former White House Director of Communications for the Energy Policy Development Group, Jim served for 11 years in the U.S. Senate, including as a Chief of Staff. Jim is an honors graduate of Georgetown University.

- Jeff Mason, Controller. Jeff is a graduate of Western State College of Colorado (BA, Accounting and Business Administration) and has over 30 years of accounting and auditing experience. Most recently, Jeff was the Corporate Controller at Alacer Gold Corp., where he was responsible for developing, implementing and maintaining accounting processes and controls from the pre-development stage through production.

- Rick Sixberry, Director of Process Development. Rick Sixberry has 39 years of experience in mining, hydrometallurgy and mineral processing. His experience includes 38 years at Molycorp’s Mountain Pass operations, where he learned rare earth processing from the ground up and held positions with operational responsibility over all aspects of the operation from drilling and blasting through product finishing. Rick was a key member of the team that re-designed and rebuilt the Mountain Pass operation between 2010 and 2014.

- Trevor Mills, Geologist. Trevor joined NioCorp in January and has over five years of combined experience in niobium, rare earth, gold, and industrial mineral industries. His background has been focused primarily on exploration and mine geology, and management of both exploration and geotechnical drilling programs. Most recently, Trevor was a consultant geologist for NioCorp supervising and managing onsite hydrogeologic and geotechnical programs on the Elk Creek Project. Previously, he was a combined exploration and pit geologist with Molycorp, Inc., working on a variety of both domestic and global projects, as well as an exploration geologist focusing on various local brownfield exploration and mine life extension drilling programs at AngloGold Ashanti (Colorado) Corp. Cripple Creek and Victor (CC&V) gold mine. Trevor is a graduate from the University of Colorado at Boulder (BA, Geology).

- Cathy Savoie, Executive Assistant to the CEO. A graduate of Michigan State University, Cathy has served in a variety of senior support roles in mining and mineral processing companies, as well as in the health care sector.

Expanded Our Extended Team of Experts

In 2015, Niocorp further expanded its team of top-shelf experts and supporting partners who are working to progress the Company’s Elk Creek Project to commercial reality. The NioCorp team now includes these highly rated entities:

- BDO

- Boughton Law

- Credit Suisse

- Dahrouge Geological Consulting Ltd.

- Envirotech Drilling

- Hazen

- IDEA Drilling

- Kovit Engineering

- KPM Kingston Process Metallurgy, Inc.

- Mackie Research Capital Corp.

- Morgan Stanley

- Northcott Capital Limited

- Olsson Associates

- OnG Commodities

- Roche / Norda Stelo

- Roskill Consulting Group

- SGS

- SRK Consulting (U.S.), Inc.

- ThyssenKrupp

- Veolia

- XPS Consulting & Testwork Services

_________________________________

Footnotes

1 The basis for the October 2015 PEA2 was a 2,700 tonne per day production rate over a 32-year operating life with an average feed grade of 0.80% Nb2O5, 2.84% TiO2 and 73 ppm Sc. Economics were calculated on an 8% discount rate.

2 NioCorp’s determination of enterprise value may not be comparable to that reported by other companies, especially those in other industries, since “enterprise value” is not a measure reported pursuant to Generally Accepted Accounting Principles or International Financial Reporting Standards. For more information on the financial condition and performance of NioCorp, as well as changes to its share capitalization, please refer to the audited annual and unaudited interim consolidated financial statements of NioCorp, available under NioCorp’s profile at www.sedar.com.

Qualified Persons

Jeff Osborn, BSc Mining, MMSAQP of SRK Consulting (U.S.), Inc., a Qualified Person as defined by National Instrument 43-101, has overall responsibility for the SRK portions of the Elk Creek PEA reports and has read and approved the technical information contained herein.

About NioCorp

NioCorp is developing the Elk Creek Niobium / Scandium / Titanium project in Southeast Nebraska. Niobium is used to produce High Strength, Low Alloy (“HSLA”) steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium can be combined with Aluminum to make an alloy with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor and medical implants.

Cautionary Statements

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release. The Mineral Resource presented in the October 2015 PEA2 has been reported following CIM guidelines. The October 2015 PEA2 is preliminary in nature and it includes a level of engineering precision and assumptions which are currently considered too speculative to have the economic considerations applied to them that would enable Mineral Resources to be categorized as Mineral Reserves. Inferred Mineral Resources are not included in the mine plan for the October 2015 PEA2. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The October 2015 PEA2 includes price and market assumptions concerning an expanded demand in the scandium market. There is no certainty that the October 2015 PEA2 will be realized. Certain statements contained in this press release may constitute forward-looking statements. Such forward-looking statements are based upon NioCorp’s reasonable expectations and business plan at the date hereof, which are subject to change depending on economic, political and competitive circumstances and contingencies. Readers are cautioned that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause a change in such assumptions and the actual outcomes and estimates to be materially different from those estimated or anticipated future results, achievements or position expressed or implied by those forward-looking statements. Risks, uncertainties and other factors that could cause NioCorp’s plans or prospects to change include changes in demand for and price of commodities (such as fuel and electricity and the commodities being explored and proposed for development by NioCorp – niobium, titanium, and scandium) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections / expectations or may not realize the perceived potential of NioCorp’s projects; risks of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business. NioCorp disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise revise any forward-looking statements whether as a result of new information, future events or otherwise.